Direct-to-consumer (DTC) brands functionally go through 4 key revenue milestones and stages.

- $0-1 million

- $1-5 million

- $5-25 million

- $25+ million

We’ll focus primarily on the first 3 stages in this essay. In the end, I’ll share some common denominators of high growth consumer brands.

Stage 1: $0-1 million revenue

The first stage ($0-1M) is the toughest. It’s riddled with product challenges, inventory constraints, brand and creative playbook, tech stack selection… the list goes on.

Founders at this stage work tirelessly to achieve product-market fit.

Venture-backed (VC) backed companies are working hard to manage expectations. Bootstrapped owners are fighting their own unique battles.

Channel mix in stage 1 is normally just Facebook, PPC and email marketing. Besides COGS, ad spend is the largest expense on the P&L. Facebook and Instagram will likely make up 80% of the media mix since it’s focused on demand generation.

Creative is the most important lever to pull in performance marketing. Don’t hesitate to allocate a percentage of your paid media spend into creative.

If you’re just starting out and prefer to bootstrap your business, there are 6 simple steps you can take to build an e-commerce brand without raising capital.

- Start with content. Leverage organic as much as possible. Social platforms still possess tremendous opportunities.

- Build a community around your content.

- Build an e-commerce store. Shopify makes it easy to do it yourself.

- Leverage 1 and 2 above to drive revenue for 3.

- Runs ads to drive further growth. Focus on efficiency and effectiveness. Paying to play is part of the game.

- Focus on retention and monitor your cohorts. The only way to win long term is for people to come back to your store and buy again and again.

Raising institutional capital is great if your thesis supports venture returns. If you’re raising capital, then be sure to monitor your payback on media spend. Too often, I see companies spending more than they need to push their metrics forward. If your CPA or ROAS is not where it needs to be, then slow down to sort that out. Advertising might not be your problem. It could be PDP, conversion rates, the offer, etc.

Some early-stage companies have a tendency to solve business issues with marketing. Remember: paid media is the megaphone to your brand voice. If the brand voice is broken, your megaphone will struggle to attract people.

If you’re VC-backed and your payback on paid media is greater than 3 months, then it’s wise to slow down. As a general rule, I think about the following:

- 0-3 months: you’re good. Closer to 1 month, go faster. Closer to 3 months, slow down.

- 3-6 months: be careful.

- 6+ months: red flag. Founders will always be raising money.

These metrics become more relevant as you progress through stages 2 and 3.

DTC brands mostly trade on EBITDA multiple, so building a strong foundation in the $0-1M revenue stage will help drive great value in the following stages. There are exceptions to this (e.g. patents, unique IP), but it’s rare.

Stage 2: $1-5 million revenue

You’re achieving product-market fit. Channel mix remains the same as stage 1, but it’s supported by a more refined media strategy.

Creative, audience segmentation and messaging are starting to get dialed in as you approach $3-5M.

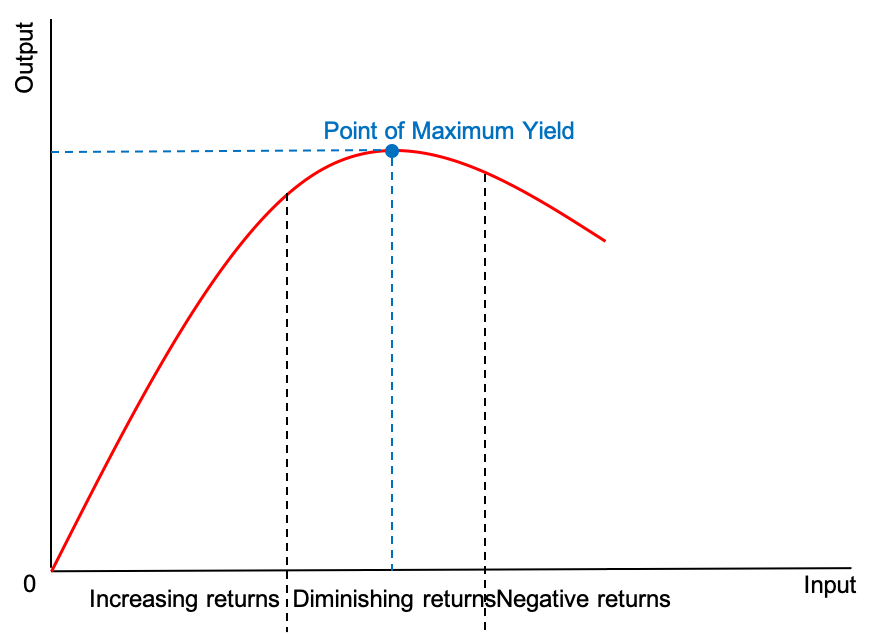

Scale feels like an exciting challenge at this stage. Sometimes brands push too hard on growth and reach an inflection point. This isn’t a bad thing. It can be good to know where you’ll see diminishing returns. You can easily pull back and ramp up again accordingly.

Demand planning should always be top of mind; especially if your suppliers require 90+ days.

Stage 2 will require brand leaders to start building out their organizational chart. Great brands care about being nimble and agile.

Here’s a good visual for how to think through stage 2.

Stage 3: $5-25 million revenue

People, process, tools. What got you here won’t get you there.

Retail and wholesale start to become a great opportunity.

As brands cross $10M in revenue, the strong foundations will start to pay dividends, but the mechanics of the org will change.

Brand leaders will have to invest in talent. Hire experienced people that know the category well and have done the role before. When hiring, you should share OKRs and set proper expectations before hiring. Try to get alignment from the candidate before bringing them on. It’s mutually beneficial to both parties. I cover this in detail in my notes for hiring at startups.

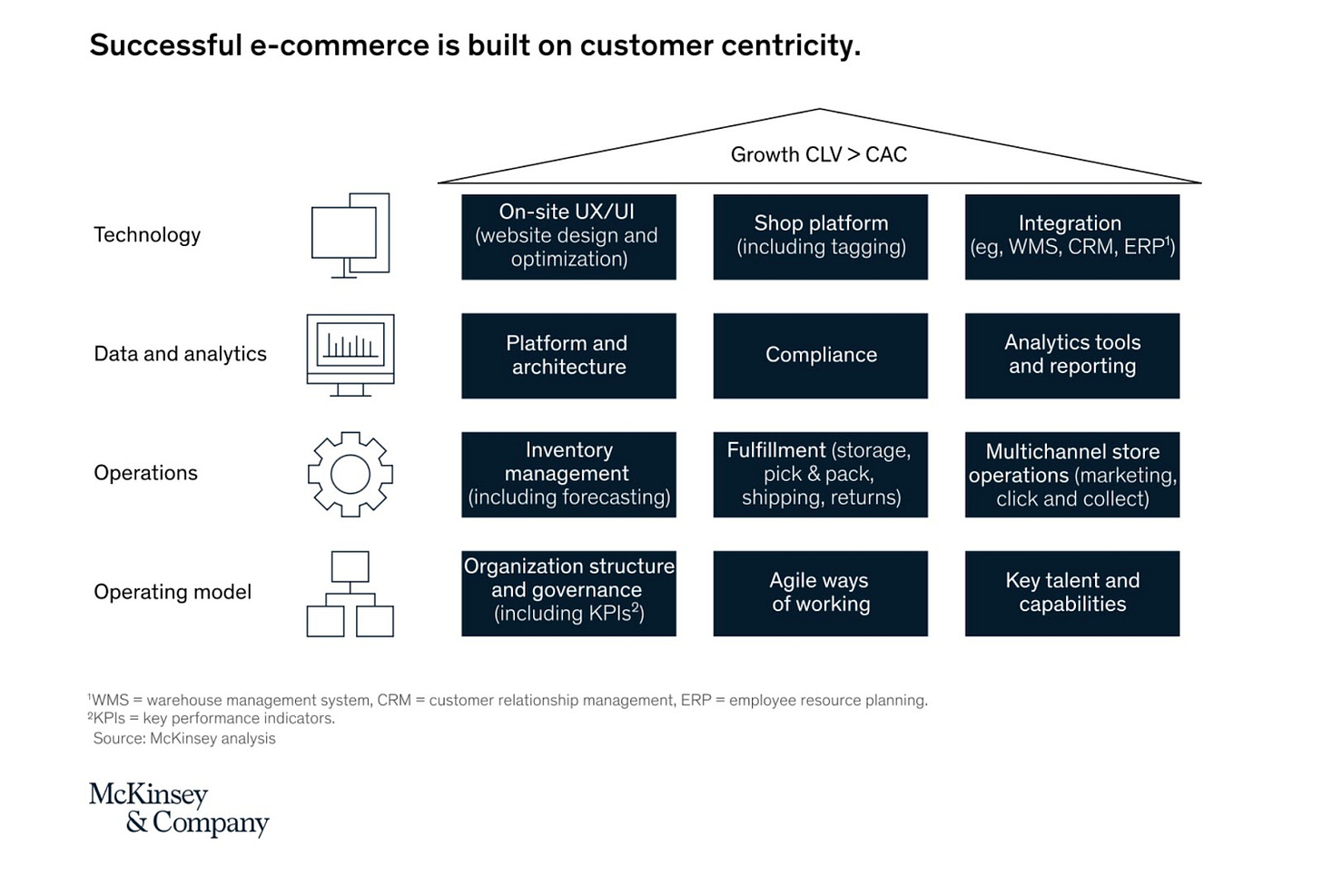

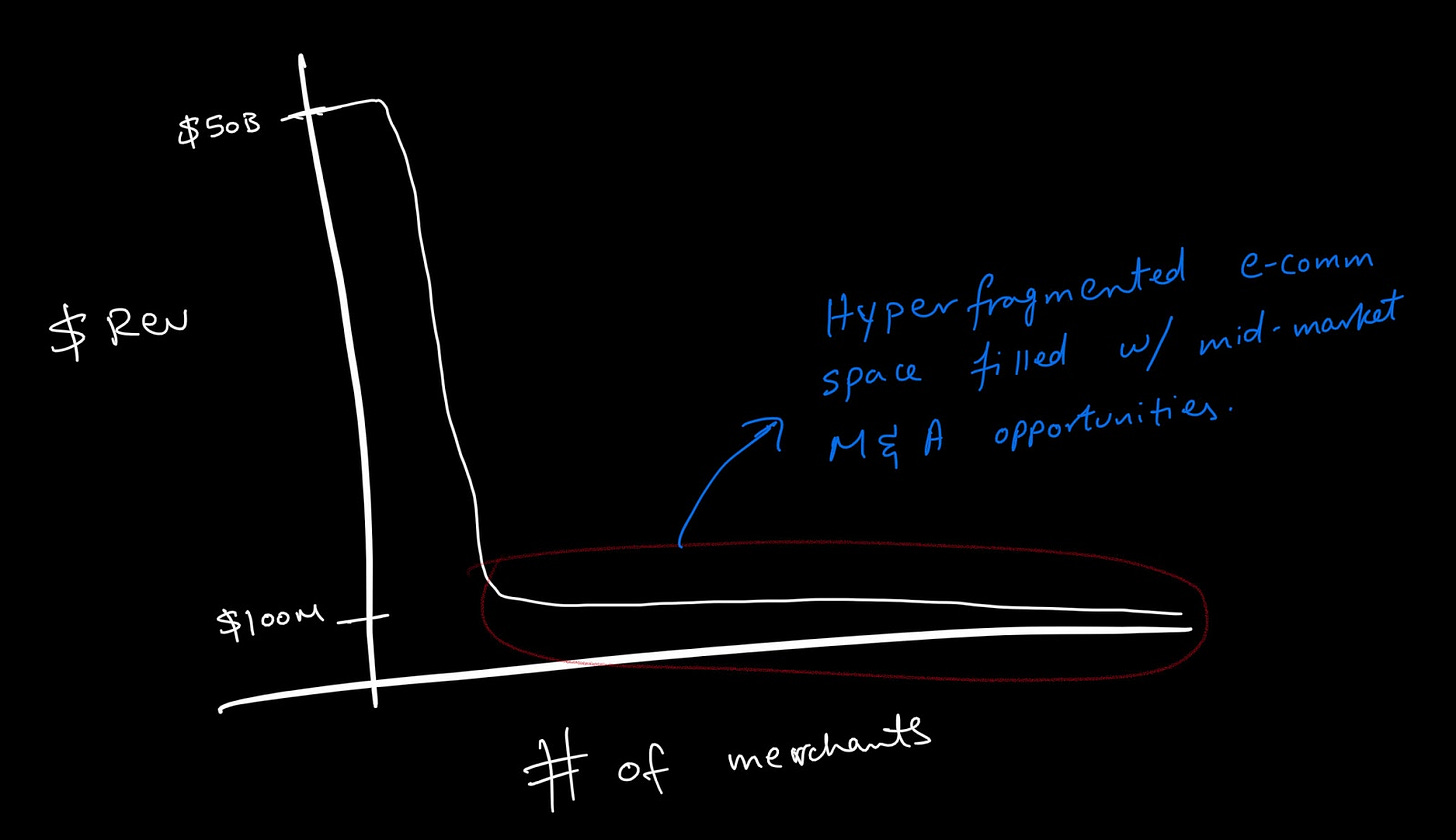

This stage of growth is critical. Most brands get stuck at this stage; 90%+ e-commerce brands live within stages 1-3. Generally speaking, e-commerce and DTC, in particular, is hyper-fragmented. The long tail captures the majority of merchants and brands. Below is a visual capturing this ethos.

Side note: there will likely be meaningful M&A activity in e-commerce in the future as consolidation comes into the conversation. There will be strong activity in stage 2, but likely by small holding companies. Best opportunities will sit within stage 3. Stage 4 companies can likely acquire stage 2 and 3.

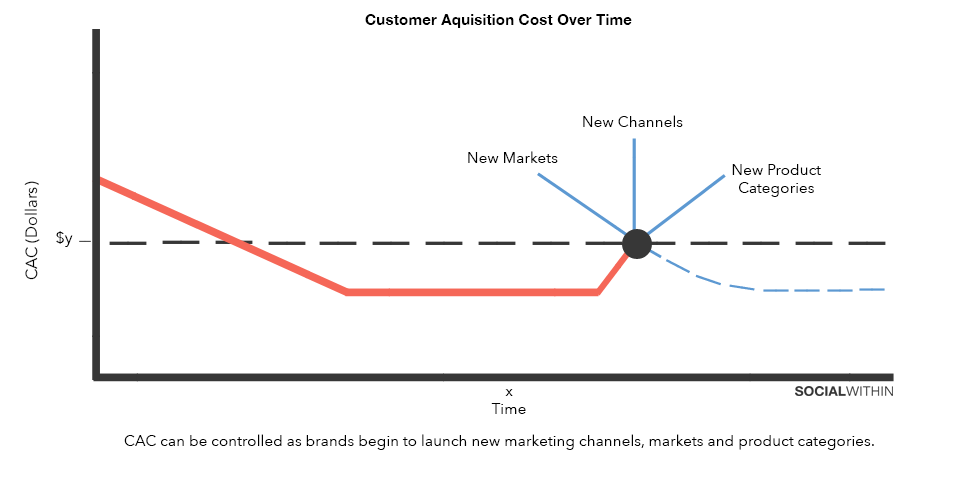

A key thing that comes up in conversation is CAC coming down over time. For digitally-enabled brands, this rarely happens. At a channel level, CACs increase and channels become less efficient over time, and if the product catalog does not get diversified or enough effort isn’t put into retention, then cohorts get stale.

Over time, the blended CAC simply ends up following the leading channel.

There are ways to escape velocity and jump into stage 4.

Stage 4: $25+ million revenue

This is where brands will have a robust channel mix. There will still be some over-indexation on 1-2 key channels, but brands will have 8-10 channels live to diversify their risk.

Retail and wholesale now become a big opportunity. Brand leaders have to find a way to scale this alongside their direct efforts.

Stages 1-3 require brands to go inch-wide-mile-deep in each component. As they graduate to stage 4, they have to go mile-wide-mile-deep. They must have people, processes, tools and partners to support that growth.

Now that we’ve covered stages of growth, let’s talk about things high growth brands have in common:

- Strong margins and high AOV

- Strong margins have to be built into the pricing strategy. All else being equal, most brands play oCPM and CAC games. This should be done responsibly. Performance marketing is addicting.

- Business model has loyalty loops and retention built-in

- Best brands prioritize retention. New customer acquisition eventually gets expensive.

- Cross-border activation is simple

- Smaller products that are easily shippable overseas make it easier to diversify against single-channel-market risk. There was a period in time, where CPMs in Australia were ⅓ of what they were in the US yet the GDP per capita in AU is similar to the US.

- Product is a consumable and impulse buy

- Shorter sales cycle. If the consideration phase is long, you end up spending more money on retargeting, messaging, creative and more. Which drives CAC up. Attribution is also easier since sales can happen within a 1-day click window.

These companies have 70%+ gross margins. This number varies across categories. Beauty can operate 90%+ while food and beverage might be at 30-40%.

Non-subscription brands that have $100+ AOV will do better than those that don’t. This doesn’t mean they can’t scale, but $90 AOV and $120 AOV can sometimes have the same CAC. Except the latter will have a better operating margin.

For subscription brands, achieving these retention metrics is a healthy sign:

- 85%+ for month 1

- 50%+ for month 6

Track your LTV/CAC ratio monthly. Anything above 4X is typically good. Identifying the appropriate time frame for LTV is key.

For conversion rates on-site (this is all traffic in Google Analytics), anything above 3% is good. Anything above 4% is terrific. High AOV items don’t typically observe this; there’s a price and volume trade-off.

For paid media, these are healthy metrics:

- Link through CTRs: 1%+

- Link through CPCs: less than $1

- CPMs: less than $10

These are not benchmarks. They are merely directional metrics that I’ve observed. There are many great brands that have been built that don’t have these numbers. They expanded into lucrative categories, had fantastic retention, launched into new markets fast, etc.

Next-generation brands will share commonality with brands that have come before them, but they’ll actively think of unconventional ways to become top of mind for consumers. They will prioritize brand development above all. It will be defined by digital experience, CX, product quality, sustainable supply chain, and so on. A combination of all this will help create an economic moat.