“It is an old joke that the stock market has predicted seven of the last two recessions. Markets are often wrong.” – George Soros

The market is too optimistic. The Fed is too pessimistic.

We’re living in a world where good news is bad news; at least when it comes to capital markets. Growth in GDP and a strong labor market is typically good news, but not in an inflationary environment.

If you look at recent market behavior, you’ll notice investors’ tendency to follow the data. Latest reduction in CPI print can spike NASDAQ by 5% in one day. If you’re an analyst, you’re adjusting DCF analysis on the go and making buy-sell decisions on speculation of what the Fed might do; especially when the Fed, itself, openly suggests that they, too, are data-dependent.

We know that rate cuts raise asset prices while increasing rates reduce asset prices.

A stock (a company) is worth the net present value of its future cash flows, but to understand the present value, we have to measure the discount rate. When rates rise, the discount rate goes up and the current value of future cash flows becomes discounted at a higher rate.

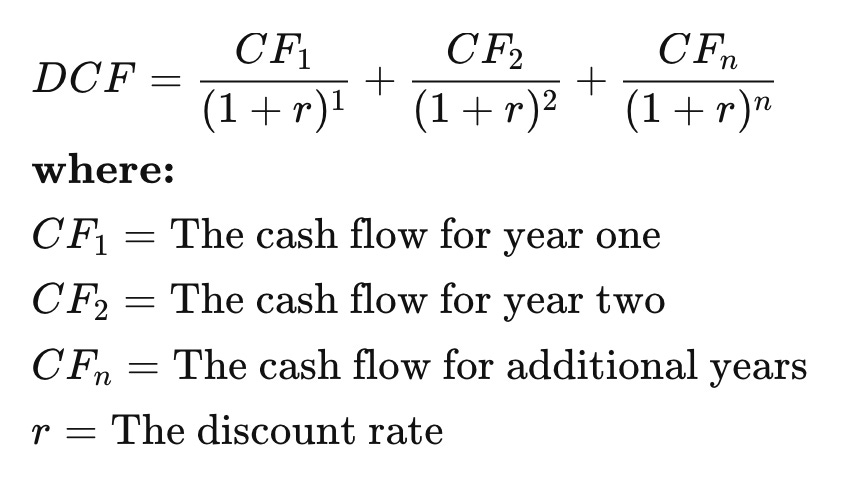

Discounted Cash Flow

You can value any asset through a simple discounted cash flow (DCF) analysis.

The “r” is the key component here. Because as interest rates change, the prospect of future cash flow evolves.

So, what does this mean for you:

- If you’re an investor: stay patient with your cash. Dry powder is paramount as deals will open up once the Fed settles into the new regime. Studying the Volcker era can reveal more about the Fed mindset. I wrote about it briefly here. Remember that from 1964-81, the stock market didn’t have any gains while our GDP grew tremendously. Interest rates rose dramatically during this period.

- If you’re an entrepreneur or operator: focus on free cash flow. Manage your liquidity well. Here are the things I’m advising my portfolio:

- Improve cash conversion cycle: I’ll write a more thorough essay on this topic soon, but for now, understand this…

- (DSO) Days Says Outstanding – number of days it takes to collect cash needs to be reduced. Improve your DSO.

- (DPO) Days Payable Outstanding – number of days it takes to pay others needs to be increased.

- (DIO) Days Inventory Outstanding – find ways to reduce inventory on hand by selling more and doing it faster while negotiating with your suppliers to charge you once the product is shipped (… while requesting a payment term if possible)

- Be relentless about expense management across all departments. Only spend on things you need. E.g. No, you don’t need to pay $15,000/year for a LinkedIn recruiter license. No, you don’t need to pay for a “nice-to-have” data tool that will take 6 months to implement and need consultants to help throughout the year.

- Cash flow from operations. Keep a close eye on your 13-week cash flow statement. It’s the main progress report of your business. P&L tells you about the health of your company over a period of time. A balance sheet tells you about your business at a period of time. Nothing beats having a close pulse on the weekly flow cash flow forecast.

- Financing. Understand your debt obligations and covenants. As rates rise, so does debt servicing. It causes an enormous amount of stress on founders when debt servicing gets out of whack. As a CFO partner, we aim to lock arms with founders on this. Whether it’s restructuring, consolidating or refinancing debt.

- Improve cash conversion cycle: I’ll write a more thorough essay on this topic soon, but for now, understand this…

Here’s an extremely simple cash flow statement template you can use.

Changing Mindset

Founders, investors and operators alike have to make more selective investments. The tide has changed. Profitability and cash flow matter in a rising rates environment. Growth at all cost won’t be rewarded like it was in 2021 and years prior. Enterprise value creation will come from how productive an asset can be versus just top-line growth.