“Anxiety is just your mind trying to experience failure in the future. Be present.” — Seth Godin

Cash Conversion Cycle (CCC) or simply, the cash cycle, of any business helps founders and operators manage their liquidity. I wrote about discounted cash flows (DCF) recently, where I captured a teaser to a longer discussion point of CCC.

If you know me, you know that I hate complexity.

I think complexity is the enemy of execution. It vacuums up resources and creates a cognitive load that causes stress. This is true for everyone, but it’s especially true for business owners that are trying to build and manage a good business.

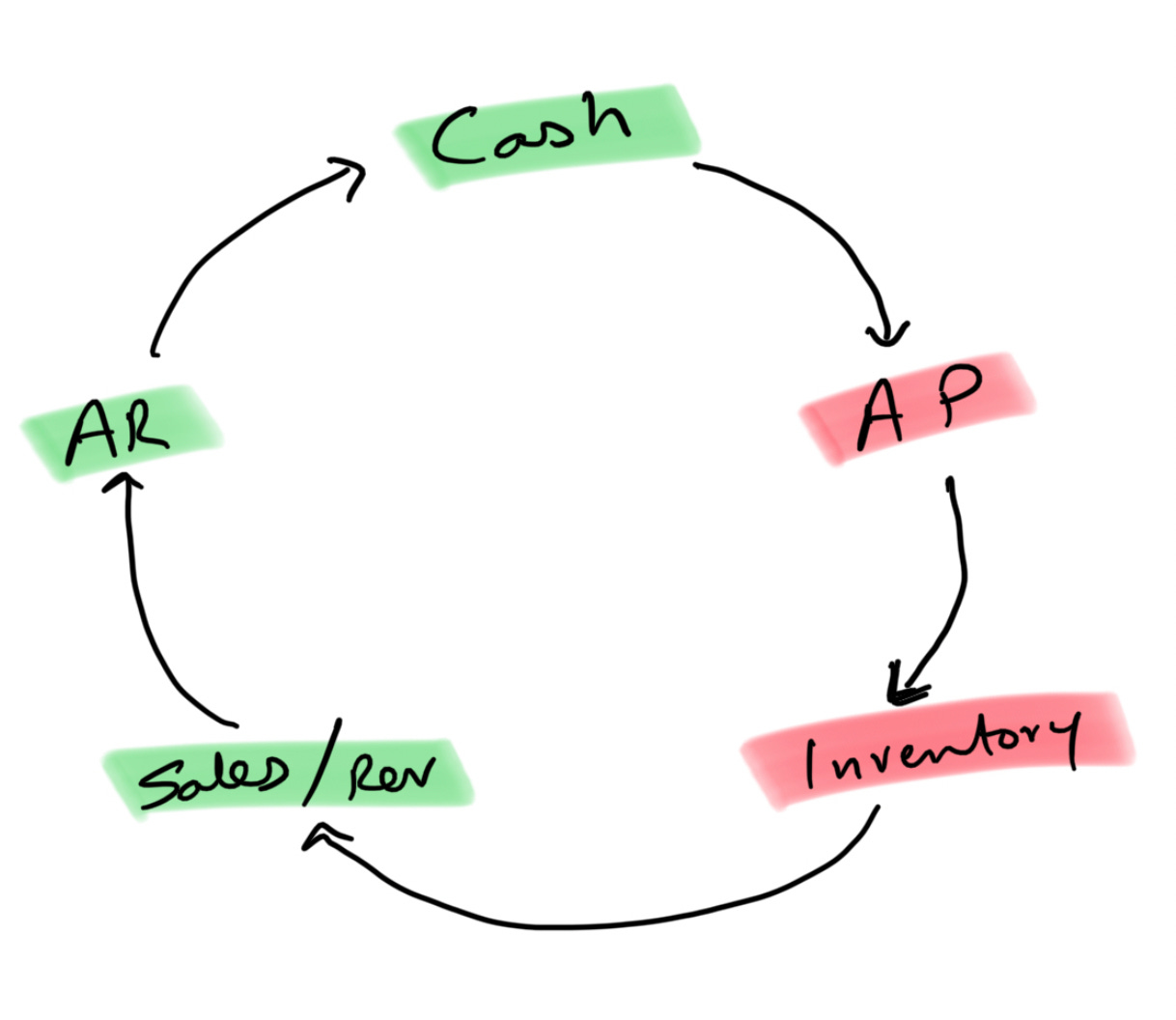

When it comes to CCC, this is all you need to know:

When your operating working capital asset (e.g. inventory) increases, it’s an outflow of cash. In other words, it reduces your free cash flow (FCF).

Since your working capital is current operating assets – current operating liabilities, you want to reduce how much cash gets tied up in working capital. When the inventory balance goes up, your cash gets locked up in the operations of your business. It can take longer to sell the inventory on hand. Regardless of how quickly you can collect from customers, this becomes a drag on your CCC.

Your CCC is connected to both the P&L and the balance sheet. On the balance sheet, inventory is an asset and accounts payable (AP) is a liability. But when it comes to cash, they both take cash out of the business. A good balance sheet is a leading indicator of a good potential cash position. A bad balance sheet is a reverse.

So, how do you calculate CCC?

CCC = DIO + DSO – DPO; where, DIO = Days Inventory Outstanding, DSO = Days Sales Outstanding, and DPO = Days Payable Outstanding.

What lowers your CCC?

DIO is (avg inventory / COGS) x 365. How quickly you can sell inventory.

DSO = how fast you can collect from receivables outstanding.

DPO = how slow you can pay from payables outstanding.

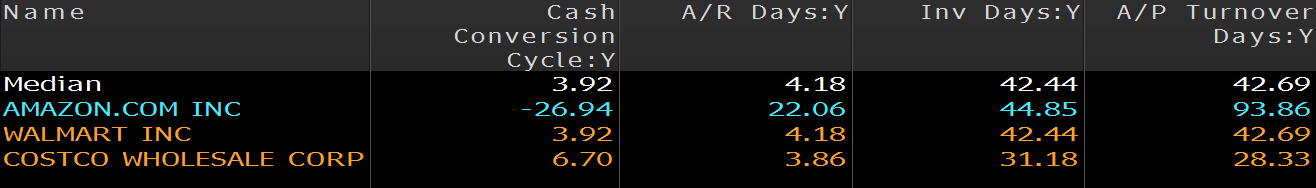

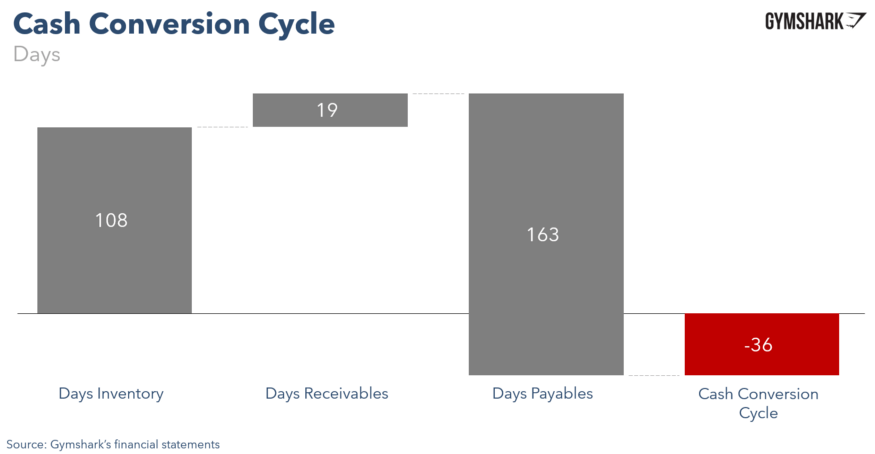

The lower your CCC, the better you are. There are some businesses out there that operate on negative CCC. These are the best businesses in my opinion, but these are very rare. Negative CCC means a company can receive payment for a product before paying suppliers/vendors. Here are two examples:

AMAZON

GYM SHARK

You don’t have to know all the accounting nuances to have a strong grip on your cash, but if you can understand the following, you’ll be 80% there.

- Profit doesn’t equal free cash flow. Focus on both.

- AR is a prerequisite to cash. Collect faster.

- AP isn’t a to-do list item on your checklist. It’s a key lever in improving your CCC. Negotiate longer payment terms with suppliers/vendors.

If you finished reading this week’s letter, then go through your vendor list, and create a spreadsheet of how much you normally pay them, and list what the payment terms are. Email them to schedule a call and gently negotiate those payment terms. Ask for more. Use recessionary pressure and interest rate rise as talking points. But make sure they know that you’re a good business. If they assume you’re in a bad financial position, you’ll give away your leverage and they won’t be inclined to give you longer payment terms.

After all, they, too, have to manage their own CCC, and if they think their AR is at risk, they won’t have the incentive to give you a better payment term.