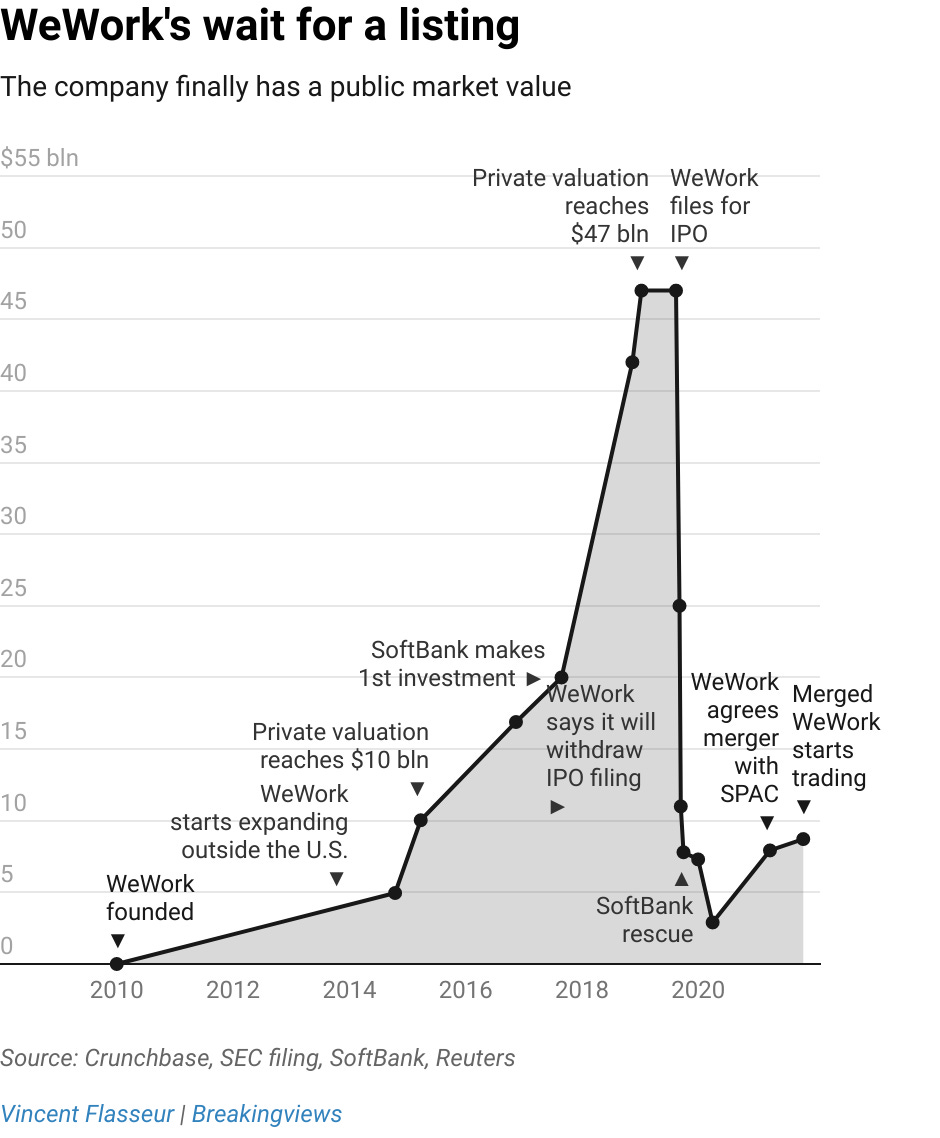

WeWork filed for Chapter 11 bankruptcy on Nov 6, 2023.

Here’s the preface on my LinkedIn post.

To understand why WeWork filed for bankruptcy, let’s first take a look at their financials to better understand the situation.

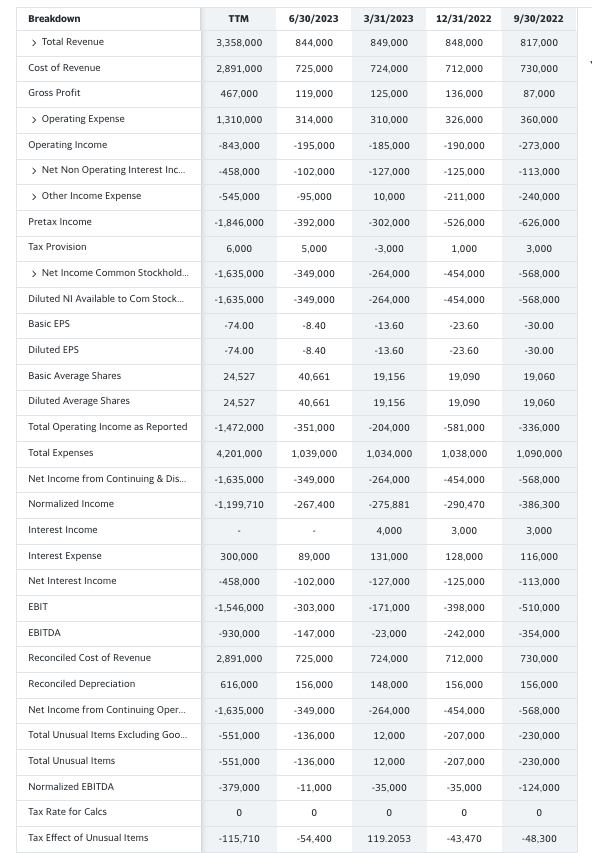

Income Statement

When analyzing the P&L, I like to start with margin analysis.

WeWork earns a GM of $467M on $3.358B in revenue; accounting for approx 14% GM. It had an OPEX of $1.31B yielding an operating loss of -$843M (-11%). Net income of -$1.635B (-48%). All metrics on a trailing 12-month basis (TTM).

In short, it’s a cash burner. Cost of location operating expenses (excluding depreciation and amortization) is at 86% which sucks the life out of the business. Either WeWork has a pricing problem or they need to significantly reduce location opex.

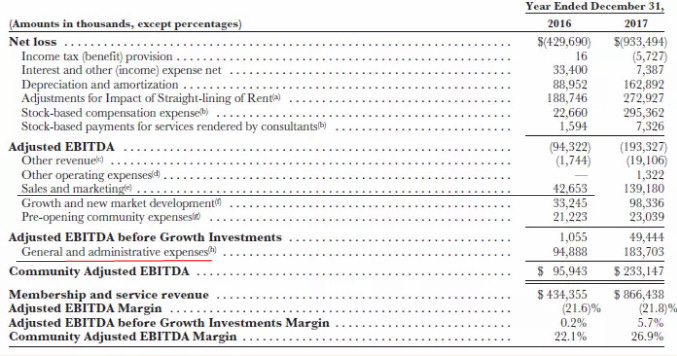

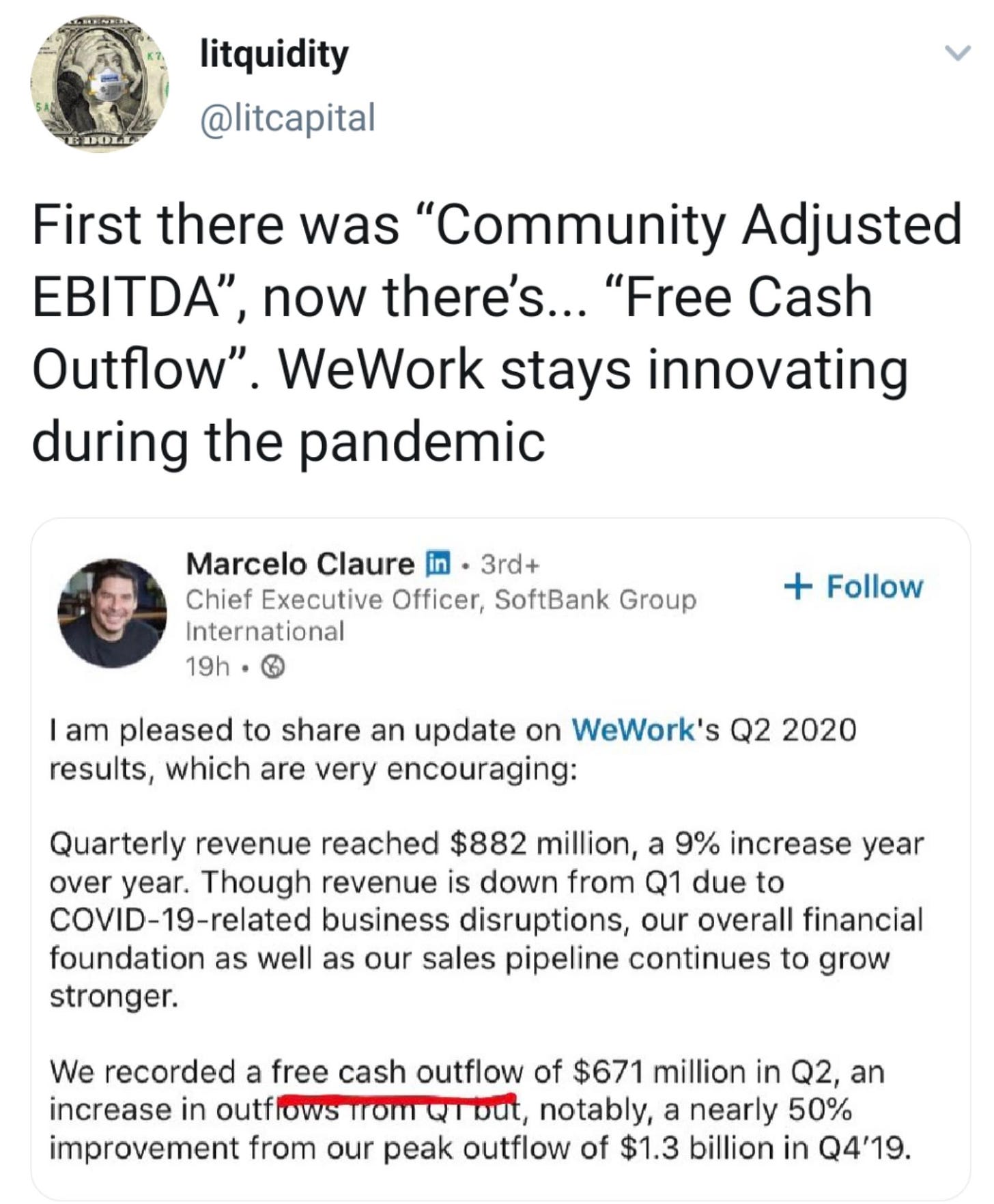

We can scrutinize each part of the income statement… starting with the Community Adjusted EBITDA that was used in pre-IPO filings.

If we go through the trendline and rewind from the early days of WeWork, we notice the same thing: the cost of revenue is simply too high. Always remember that when a company uses creative accounting tactics to display its financial reporting, they have a business model problem.

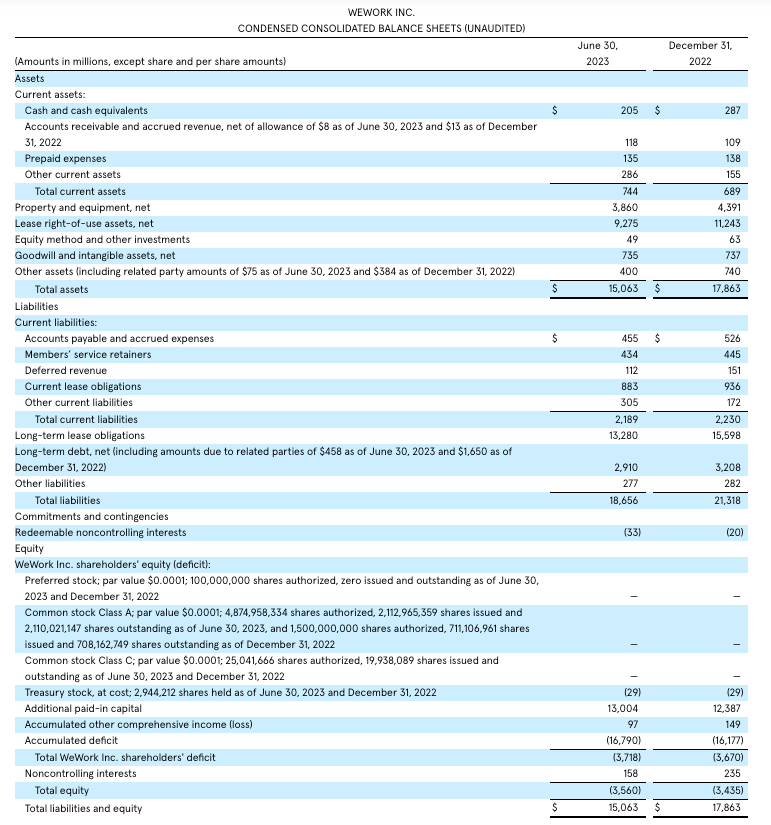

In simple terms, a company’s P&L tells us about the business over a period of time (think of it like a movie); whereas the balance sheet tells us about the business at a period in time (think of it like a Kodak moment).

Balance Sheet

Let’s capture the Kodak moment and understand the core reasoning behind the Chapter 11 filings.

When looking at the B/S, I start with liquidity and solvency and then work my way into working capital efficiency.

- Current Ratio looks at current assets against current liability. This helps lenders and investors assess the liquidity of a business. Can the company meet it’s short term obligations while operating the business? WeWork is currently at 0.34 when the benchmark is 1.0. This is required by practically all lenders in today’s market.

- Accounts Payable (AP) is $455M which is more than double the cash on hand

- Short term debt is almost a $1B

- Long-term debt is $2.9B

- Long-term lease obligations are mind-boggling $13.28B

Even if WeWork successfully negotiates out of vacant leases during its Chapter 11 rehab process, it still needs to restructure its debt and AP. There are a lot of creditors on the line here which can have a trickle down effect.

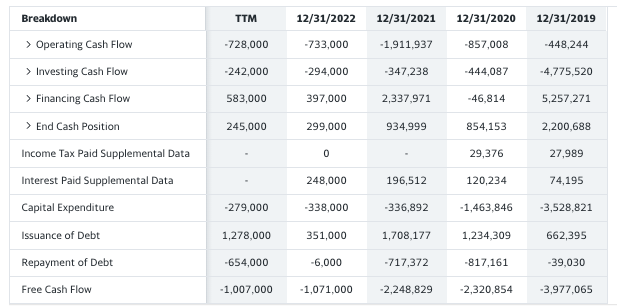

Cash Flow

Take a look at the last few years of their cash flow statement and be the judge.

The amount of cash outflow has decreased but that’s not convincing enough to make the business investible.

This Is Serious

WeWork is a distressed asset and has a liquidity problem. The cash on hand simply does not cover short-term liabilities. It will require a cash injection which further dilutes the business. Common shares are practically worth zero as-is.

Additionally, the restructuring will be challenging. WeWork has operational complexity. It has 777 locations worldwide. Trimming out still doesn’t solve for per-location expense ratio. Margins aren’t there to drive profitable growth.

Investors in today’s market are seeking alpha. They’re not interested in subsidizing capex.

In an alternative universe, WeWork is a tech-enabled REIT. Where it’s managed and operated by a private equity backed group with sober operators who are willing to trim the fat, minimize costs and maximize efficiency. They strengthen the business in core markets and leave the rest behind. Think of this scenario:

- WeWork operates at $1.67B of revenue annually at $835M of cost of revenue (providing 36% efficiency from current setup). Take 2 steps back on revenue to take 3 steps forward in efficiency of the revenue earned.

- Enable sales and marketing with a core focus on enterprise sales with long term contracts and appropriate incentives for clients. No more month-to-month.

- Minimize SG&A. This type of overhead is unproductive.

- Get rid of Kombucha and beer on tap. Stop the bagel parties. It’s a waste of money and unproductive use of capital.

- Re-think pricing structure. Selling per seat may not be the best route.

- Lean into strategic collaborations with known brands

- Make it an events space and go-hard at selling this. There’s no reason why each WeWork location shouldn’t host events several times a week.

I have been a WeWork customer since 2017. I started with a hotel desk at $500/month and eventually grew into their largest office space in the building at the time where we were paying over a quarter million per year in rent. This is a good brand with a great product. I’m hopeful that it sorts out these issues, so I can continue to be a loyal customer for years to come.