“We’re on this sugar high and I’m not saying this ends in a depression [but] I think there are more inflationary forces out there.” – Jamie Dimon, CEO of JP Morgan (Nov 28, 2023)

The Fed meeting minutes were released earlier this week and it’s a buzz kill for capital market bulls that priced in multiple rate cuts (-150 bps) in 2024.

There’s a dichotomy between what the Fed is saying, how Wall St interprets it, and what the data is saying.

Fed suggests up to 3 rate cuts in 2024. Wall St interprets there may be as many as 6. Yet the market suggests a “soft landing,” which removes the need to even cut rates.

As a refresher: The Fed (or FOMC – Federal Open Market Committee) meets 8 times a year on a set schedule. 12 members sit on the Committee and it’s chaired by Jerome Powell. During the meeting, FOMC members discuss long-term goals on price stability, labor markets, assess macro risks, and take their stance on monetary policy. They typically align on one of three goals: 1) restrictive, 2) neutral, 3) expansionary.

Here’s what we need to know: interest rates have peaked, but peak rates might be here to stay for longer than expected.

In the minutes, the Fed indicates that it plans to keep interest rates steady at 5.25-5.50% for now. It will continue to monitor the data before deciding to cut. In short, their monetary policy stance is “restrictive.”

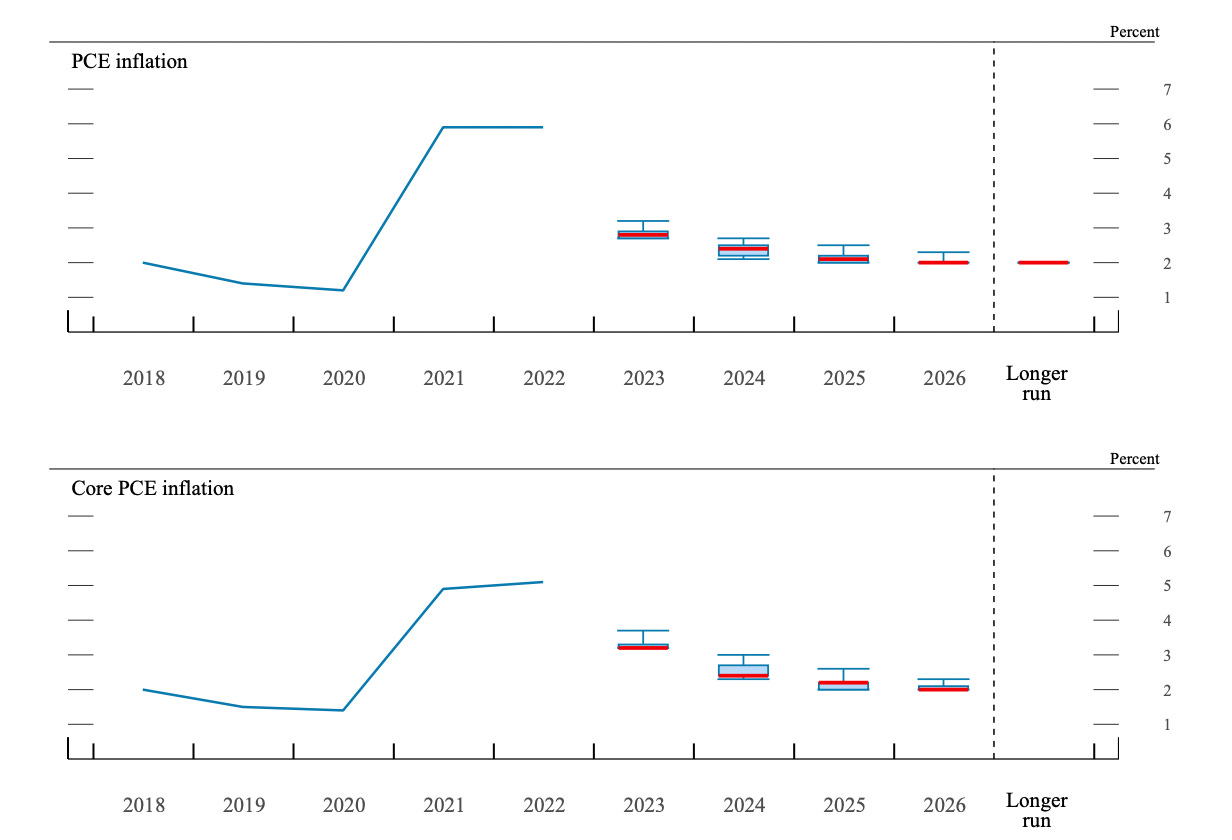

The most important chart in the meeting minutes is the one below – indicating where the Fed sees rates trending over time.

Why does this matter?

Higher cost of capital impacts everyone from consumer spending to asset prices to startups’ ability to raise capital and beyond.

- Credit conditions tightening: higher rates mean that the cost of borrowing money increases. Impacting mortgages, loans, and credit cards, making it more expensive for individuals and businesses to borrow money. GDP is driven by consumer spending and business investments. Higher rates decrease both.

- Savings become attractive: investors gravitate towards high-yield savings and fixed-income instruments when rates are higher. Pulling away from equities – impacting asset prices with lower demand for risk assets.

- Housing market demand: higher rates directly impact mortgages. Home demand normally shrinks materially when rates increase.

- Business impact: companies both large and small rely on borrowing to expand or operate face higher cost of capital and financing. This impacts margins and growth ahead. This is especially true for startups and mid-market companies. CFOs have to manage cash flow delicately and use leverage thoughtfully.

Fed Projections:

Notice anything? Cautious optimism is the theme here, but having a benign outlook doesn’t seem pragmatic given the fat-tail risks brewing. Many of these are inflationary pressures that quality investors are pricing in and underwriting. Notably:

- Geopolitical tension in Eastern Europe and the Middle East. Conflicts and wars are inflationary, not deflationary.

- Government spending and fiscal policy are inflationary. There’s no cap to the debt ceiling at the moment. And since the government can’t match revenue sources, it can increase the money supply in the market.

- The labor market remains strong. Labor print this morning (Jan 5, 2024) shows 216K jobs added, keeping the unemployment rate steady at 3.7%. This cross-pollinates into wage pressures which is inflationary.

- Other items: supply chain disruptions (Red Sea issue), rising energy prices (both transport and cut in production), etc.

Questions I’m asking and reflecting on:

- What incentive does the Fed have to cut rates 3-6 times in 2024 when inflationary pressures remain high? How much longer to see the current policy flush out of the system?

- Expansionary monetary policy is needed to help recover from a recession (i.e. rate cuts). If the Fed can successfully achieve a “soft landing,” why does it need to cut rates and risk inflation?

- Election year is a critical year; what impact will the Fed have?

- America has a debt problem. We’re addicted to debt. With consumer credit card debt and delinquency rates rising, how does this impact consumer demand in the short to mid-term? My notes here.

- S&P 500 earnings have been pulled forward by a full year in the last quarter. How sustainable is this? Is this euphoria?

- Yet, there’s a lot of liquidity sitting on the sidelines. As of this week, Total money market fund assets increased by $78.61 billion to $5.97 trillion. If asset prices fall, will they quickly recover as sidelined investors jump back in?

- Quantitative tightening is happening behind the scenes (the Fed is reducing its balance sheet). How does this impact capital markets with liquidity getting pulled out of the system?

Bottom line: bears don’t make money and speculative investors get slaughtered in this type of market environment. Taking a pragmatic, patient, and thoughtful approach to both investing and operating our business will pay dividends.