“Once you understand how and why liquidity works, you’ll fully grasp the old Wall St. adage of “Don’t fight the Fed”. The Fed controls the biggest lever on global liquidity. And liquidity is what drives stocks… NOT the economy.” – Stan Druckenmiller

Valuations and fundamentals don’t move the markets. Far too many bears argue about the separation between real economy and the stock market. They don’t understand how markets work.

At its core, two things drive markets:

- Liquidity

- Sentiment

Stan Druckenmiller is one of the greatest investors of all time. He once said:

Earnings don’t move the overall market; it’s the Federal Reserve Board… focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.

Let’s look at how this plays out.

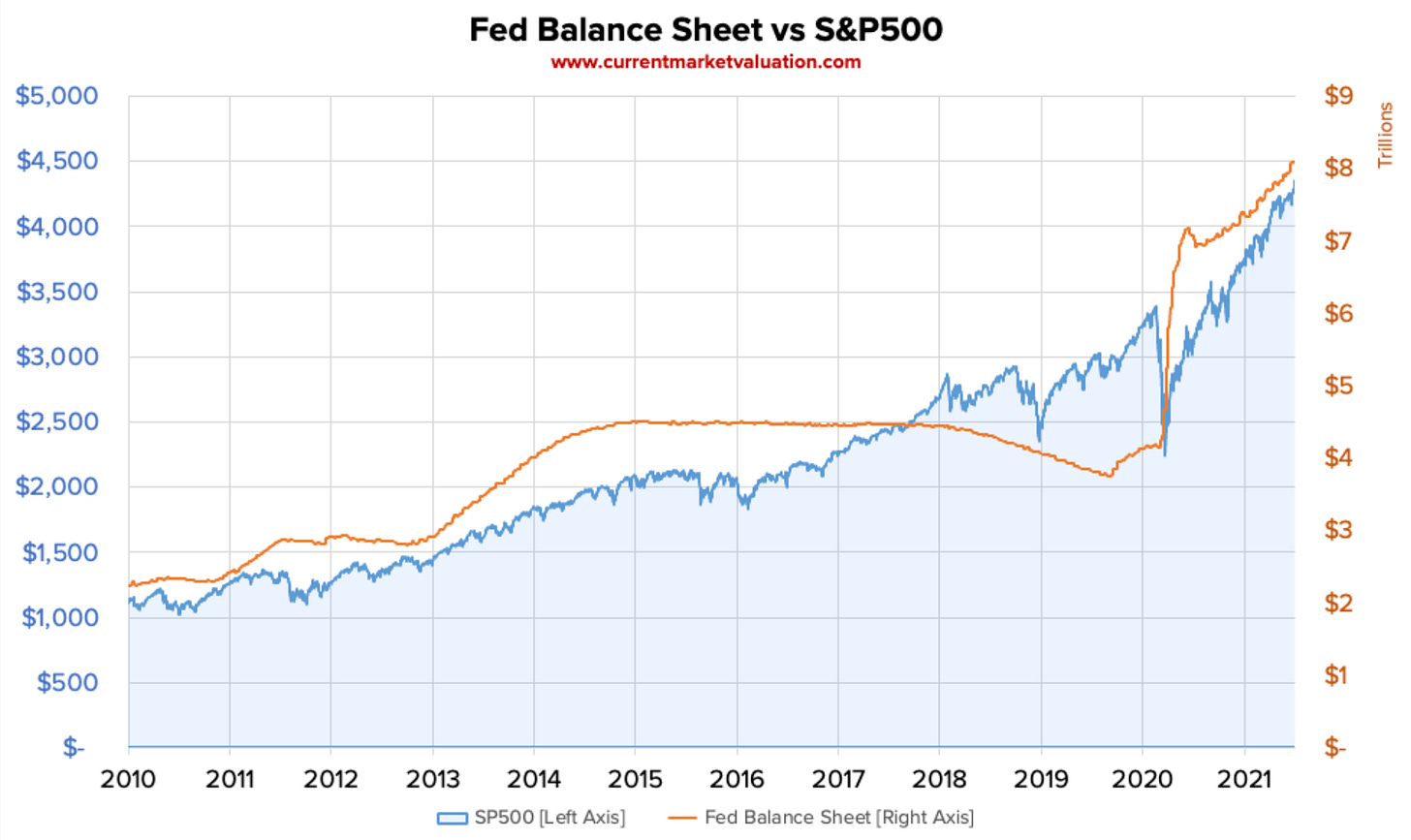

After the 2008 Global Financial Crises, The Fed started a new experiment called Quantitative Easing (QE). This became a way for The Fed to inject liquidity into the market by purchasing bonds and other financial assets.

Quick History of QE in the U.S.:

- Pre-2008 Financial Crises: Fed’s balance sheet was ~$900B.

- Nov 2008: first round of QE was agreed on and purchases began in March of 2009. At the time, The Fed started with $1.75T of QE. Specifically buying $1.25T of mortgage-backed securities, $300B of treasury securities and $200B of agency debt.

- Nov 2010 – 2015: Second round of QE began and then third round… and so on

- Jan 2015: Fed’s balance sheet reached $4.5T.

- June 2020: COVID forced Fed’s hand to accelerate QE and slash interest rates to zero. Fed started buying $80B of treasury securities and $40B of mortgage-backed assets per month!

- March 2022: Since the pandemic started, The Fed’s balance sheet has swelled to ~$9T.

So, why is the brief history above relevant? Because liquidity drives markets. Case in point below.

The more liquidity in the market and the lower the cost of capital, the higher the valuations and stock prices will reflect that.

Phase-Based Approach Fed Is Taking:

Phase 1 (current phase) is fighting inflation. The Fed is laser-focused on this objective. To do this, they’re increasing interest rates. They met last week and agreed on an additional 0.75% rate hike. Currently targeting 3-4% terminal rate for the year.

Phase 2 (and this will be done in parallel), is quantitative tightening (QT) measures. QT is the opposite of QE. The Fed will aim to reduce its balance sheet and take liquidity out of the market.

Phase 3 will be achieving equilibrium with market supply and demand. The Fed has injected so much liquidity into the market over the last 13 years that it’s to unwind some of it.

Important caveat: The Fed will get enormous pressure from the White House to not trigger a painful recession; especially as mid-term elections are approaching. Even though The Fed is an independent agency (with no political agenda), they can still get influenced by politics (regardless of their intentions).

What Explains The Recent Market Rally?

Chair Powell hinted at stopping rate hikes by end of year with eventual rate cuts late next year to stimulate growth again.

My opinion: I strongly disagree with this approach.

We’ve riddled the market with Fed intervention enough. The Fed has a desire to achieve a “neutral” state. In other words, not stimulate growth nor push for contraction.

We still have negative real interest rates. Meaning, inflation is greater than nominal rates. Example: inflation is at 10% and Fed Funds rate is at 3%, then we have an 7% delta.

The Fed is data-dependent at the moment. They’re meeting again in September and will have July and August CPI report and labor print to decide what actions to take. Assuming we see a reduction in CPI and slight increase in unemployment, The Fed will take a softer approach to raising rates (expectation is 0.50%). If CPI continues to run in the 8-10% range and unemployment stays below 4%, we can expect a 0.75-1.00% rate hike.

Interesting weeks ahead.