“It’s a recession when your neighbor loses his job; it’s a depression when you lose yours.” – Harry S Truman

A recession is created. It is engineered. It helps detox bad players from markets, reduce speculative and late cycle behaviors from investors that can cause a contagion. The declining asset prices provide an opportunity for many investors who take a longer term approach to their portfolio.

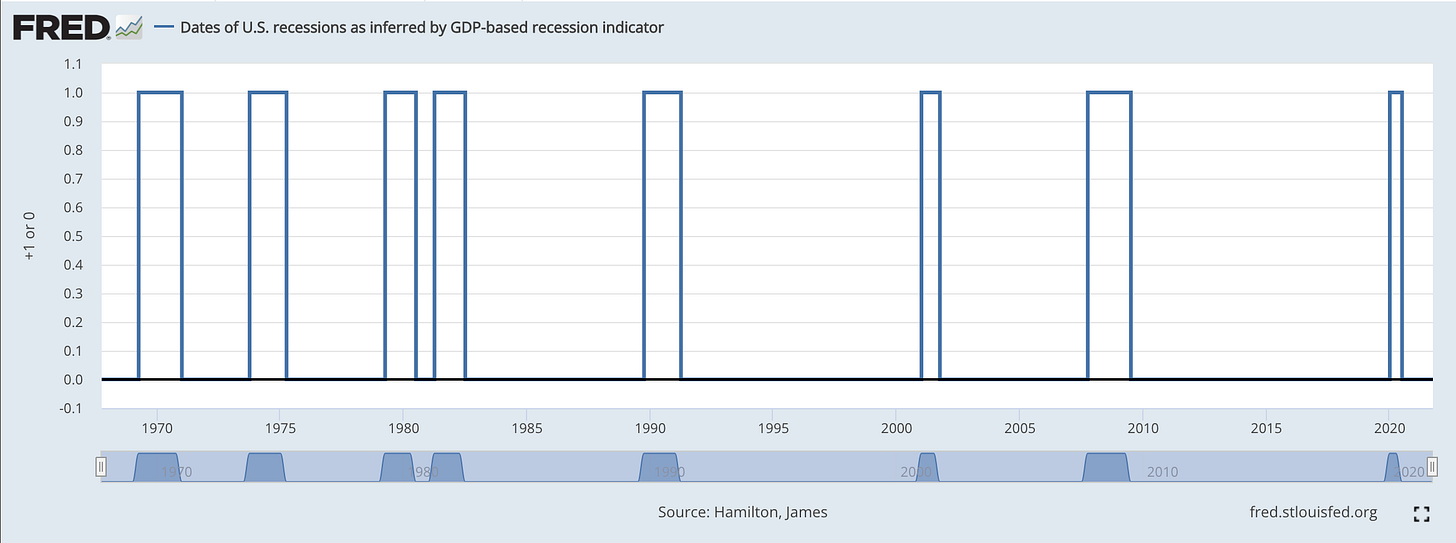

By definition, a recession is a period of declining growth. More specifically, it’s when we experience two or more quarters or negative GDP growth (6 months).

We haven’t experienced a real recession since 2008 financial crises. Here’s a brief look at recession history, and we normally experience them every 7-8 years.

Latest Job Print: 372,000 employment gain (steady 3.6% unemployment rate)

The latest jobs report for June 2022 showed an employment gain of 372,000 keeping unemployment rate steady at 3.6%.

Objectively speaking, this is positive news. Given price pressures businesses are facing, we haven’t seen a compression in labor markets.

But we’re living in a time where good news is bad news.

A tight labor market suggests The Fed will be motivated to spike interest rates even further. There’s a high likelihood that The Fed will increase interest rates by another +0.75% at the next FOMC meeting on July 26 – 27. And the following meeting scheduled for September 20th (expected rate hike of +0.50-0.75% contingent on inflation data).

Context: Federal Open Market Committee (FOMC) is a branch of The Federal Reserve Bank that sets the direction of monetary policy, setting interest rates and growth in money supply.

How To Avoid a Recession?

If The Fed can manage:

- Reduction in job vacancies (current 11.3 million job openings)

- Whilst keeping unemployment stable at 3.6%

- Whilst reducing inflation by increasing interest rates

… then we might avoid a recession.

It’s like 4D chess and it is much harder said than done… but it is possible. This would be considered a “soft landing.”

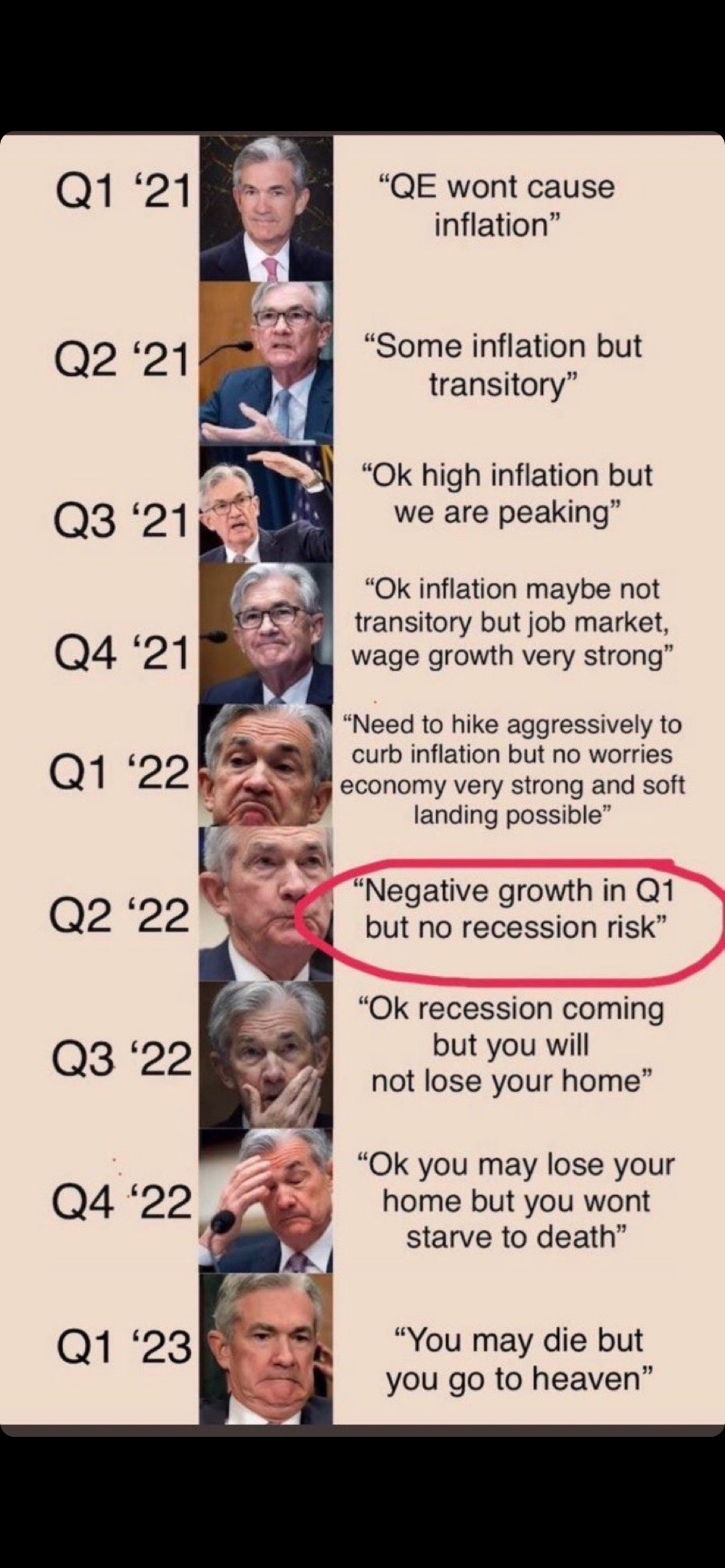

We’re heading into Q2 earnings season soon and we have a Fed meeting coming up. The Fed’s concerns have gone from inflation being “transitory” to inflation potentially being “entrenched.” And they will do everything in their power to fight inflation.

Next few weeks will be interesting.

… And to end with some humor to start the week 🙂