Q2 GDP will likely be compressed -42%, 40M people are unemployed, second wave of COVID-19 is likely approaching, and yet the stock market is seeing record highs. What drives this and why are we seeing such divergence between the market and the real economy? If you’re a market participant, this question is lingering in your mind.

The answer is short and simple. It’s The Fed.

Quick history on The Federal Reserve System. It was created by Congress back in 1913 under President Woodrow Wilson. The formal act was called “The Federal Reserve Act of 1913.” The entire purpose was to have a central bank that provides the United States with a safer, more flexible, and stable financial system.

The Fed focuses on 4 key areas:

- Drive monetary policy

- Manage and regulate banks

- Maintain stability of the financial system; protect against systematic risk

- Provide financial service to US government when needed

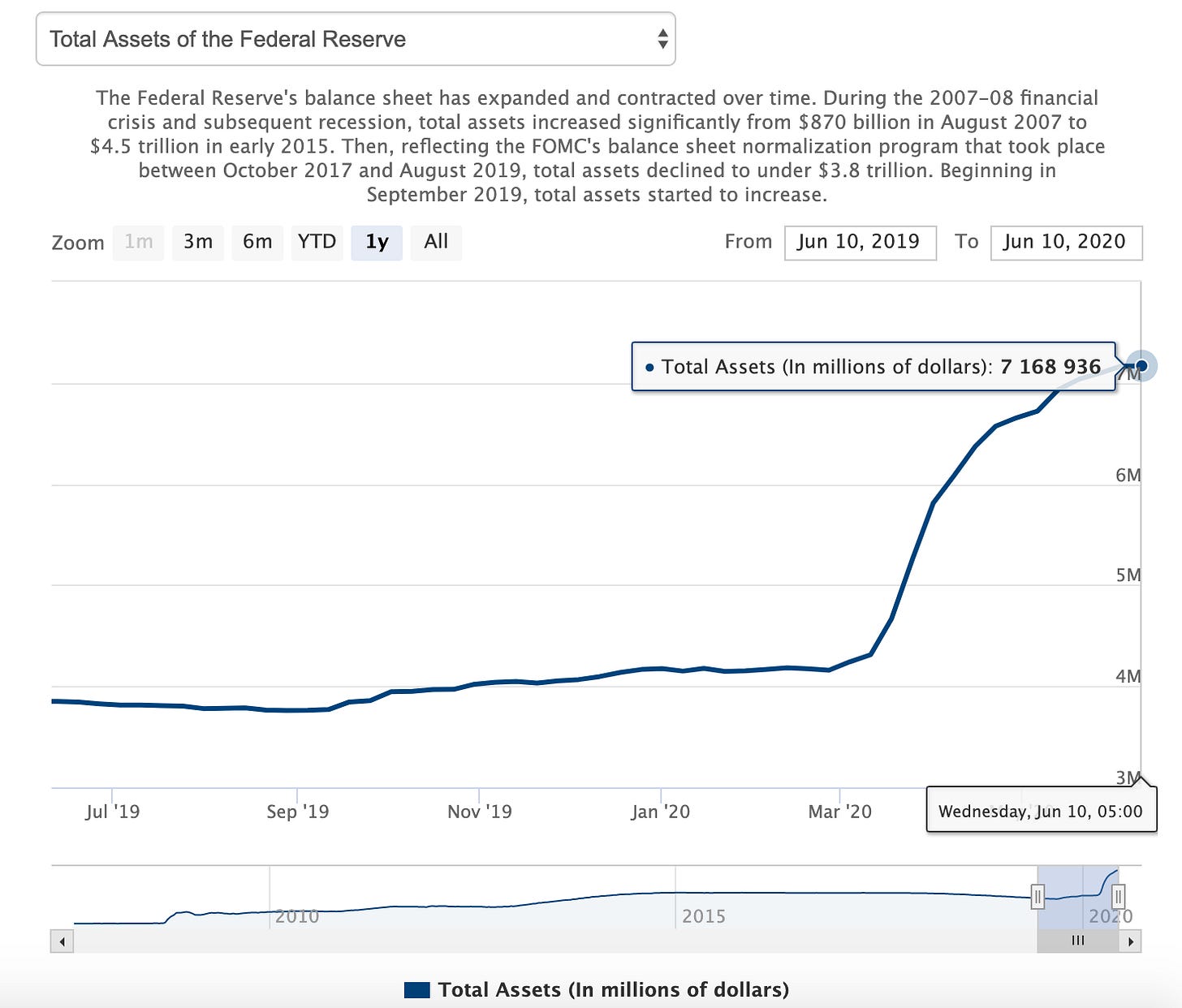

So, what does The Fed have to do with divergence? Simple. The Fed prints money. The printing leads to liquidity in financial markets. To give you perspective, here is Fed’s most recent balance sheet chart. Those numbers are in $trillions.

The Fed can print money by digitally adding zeros to their balance sheet. And by doing so, it has the ability to buy assets in the market. Currently, it’s busy buying corporate and Treasury bonds. And it shouldn’t surprise us if they start buying equities soon.

If you need entertainment on a Friday night, then watch this 60 minutes interview of Ben Bernanke from 2009. The good ol’ days when the former chairman was discussing injecting $1T into the market. J.Powell is on track to beat that by 7X.

You can fast-forward to 8 min mark to hear Bernanke talk about money printing.

What are long term repercussions? We don’t currently know. What we do know is that money printing at this rate and these liquidity levels are not sustainable. The underlying value creation of the economy comes from the consumers. And if the consumer is hurting, then no band-aid solution can solve the problem; even if it’s The Fed.