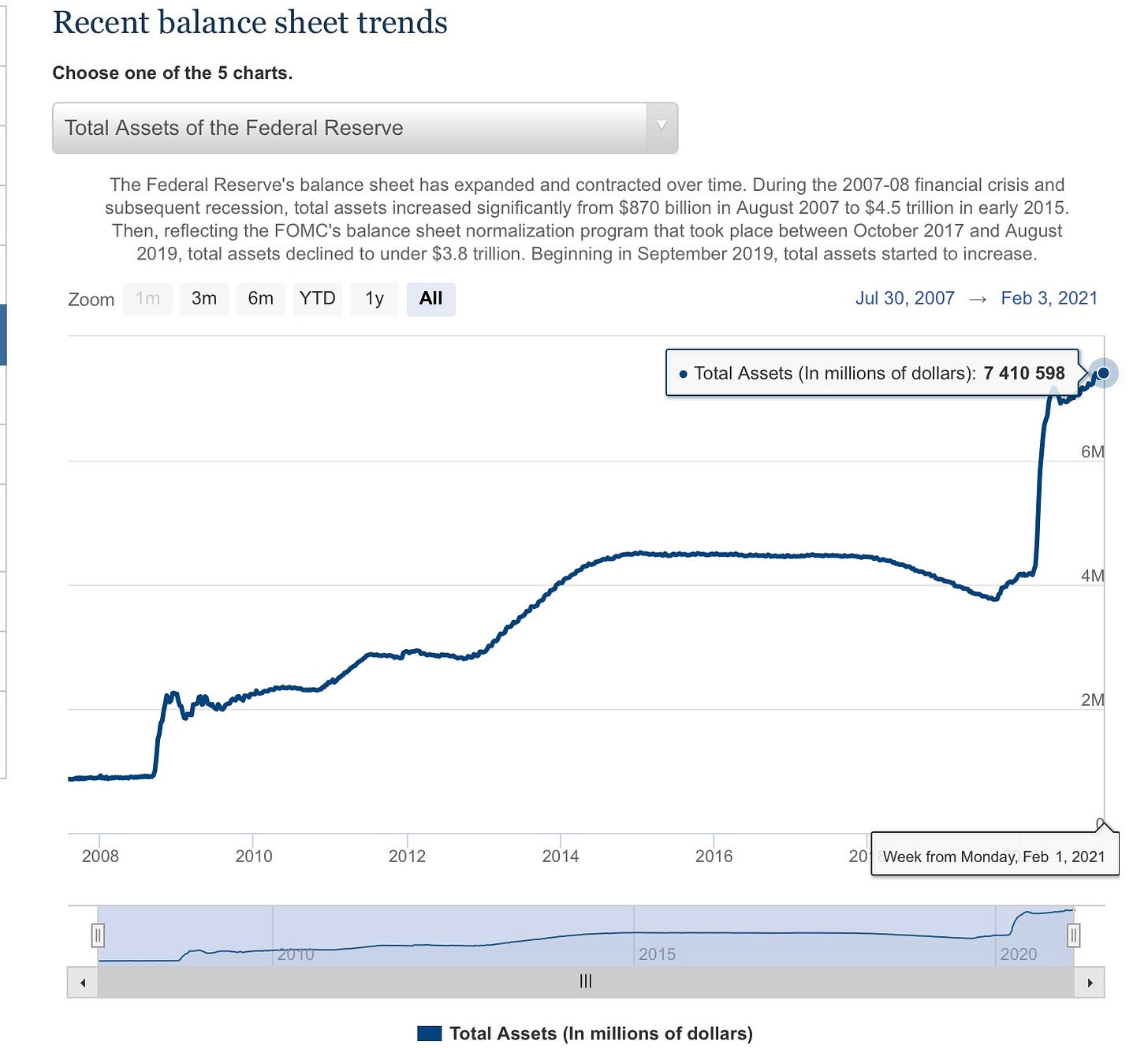

The Federal Reserve Bank has printed ~25% of all USDs ever printed in just the last 15 months. Almost $9 trillion has been printed. As investors, all of us have experienced asset price inflation; equity valuations that are sky high with no connection to fundamental analysis or real business performance.

Yes, technically, the price of an asset should be judged by someone’s willingness to pay for that asset, but there are ways to gauge the real value of equities; whether it be EBITDA multiple, revenue multiple, ARR multiple, etc. Momentum trading driving up asset prices is one thing (e.g. GameStop and r/wallstreetbets), but asset inflation caused by liquidity in the market is another thing.

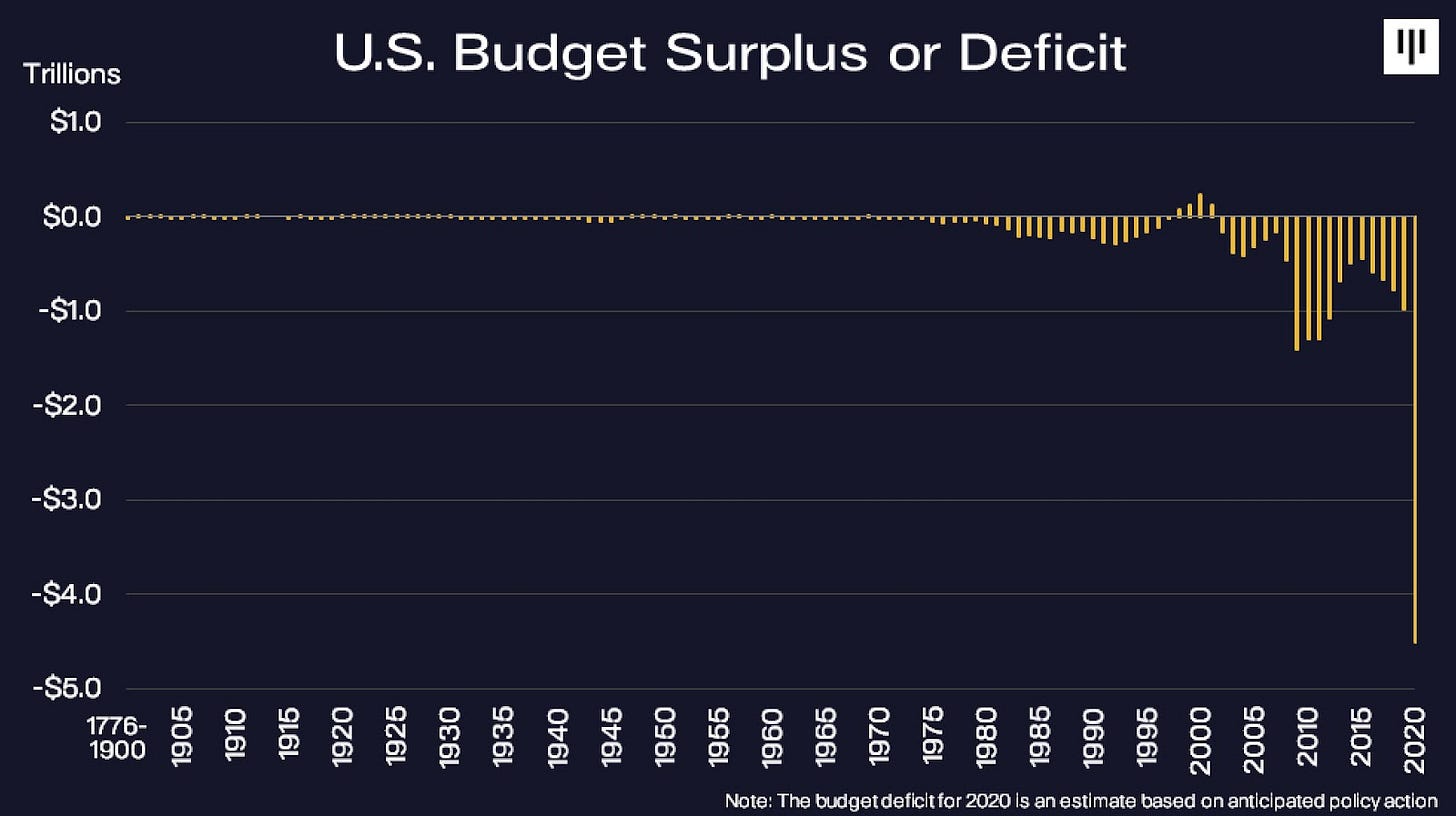

During the summer of 2020, the US budget deficit incurred for that month was larger than the debt incurred from 1776 through 1979. “Two centuries of debt in one month,” Dr. Ron Paul.

Note on asset inflation: we’re living in a time of near-zero interest rates that likely won’t be touched for the next 24-48 months, tremendous liquidity in the market, $0 commission trades for retail investors, and so on. It shouldn’t surprise us if the S&P 500 is trading at 4,500-5,000 in the next 12-18 months

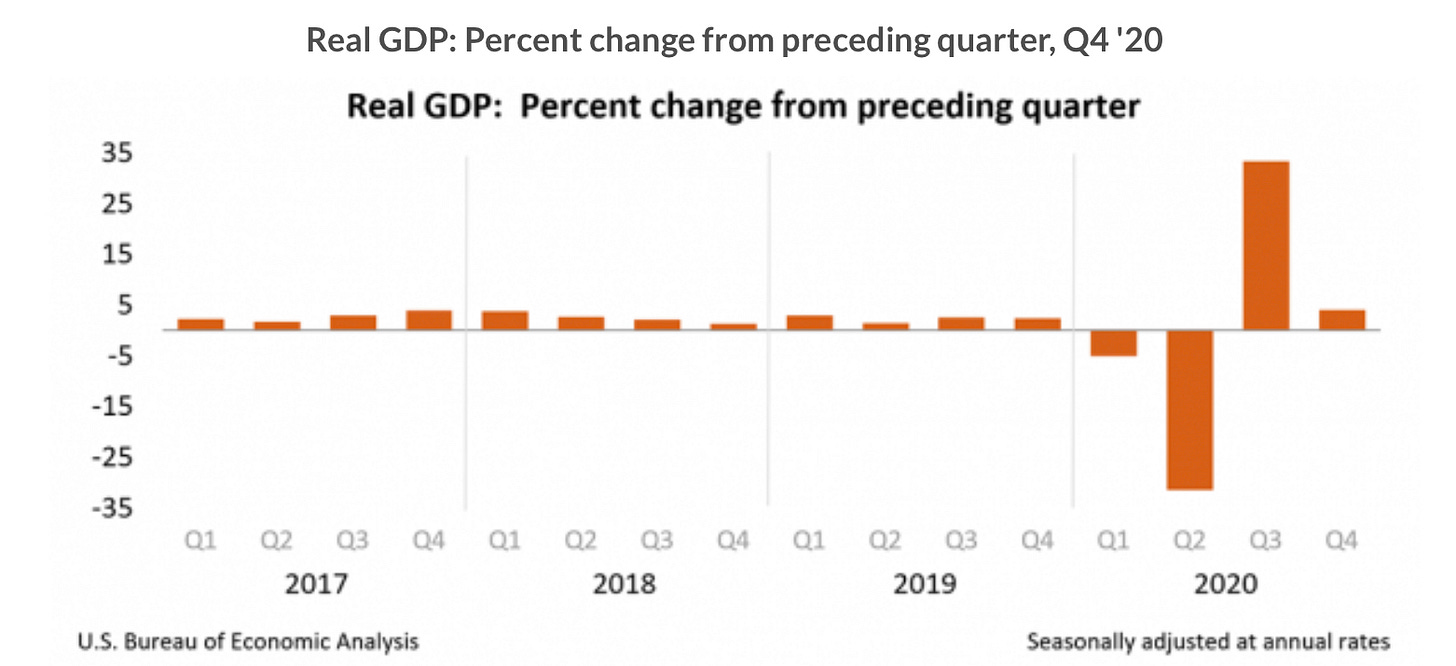

An economy grows when its GDP and productivity increases. In 2020, US GDP declined by 2.3% ($500.6B) from 2019, which grew 4.0% ($821.3B) from previous year.

Eventually, liquidity in capital markets (and asset price inflation thereof) will make its way into normal goods and services; this is on top of the fiscal stimulus plan that is being passed by the current administration.

The US has not seen significant inflation in the last two decades, but that will likely change soon.