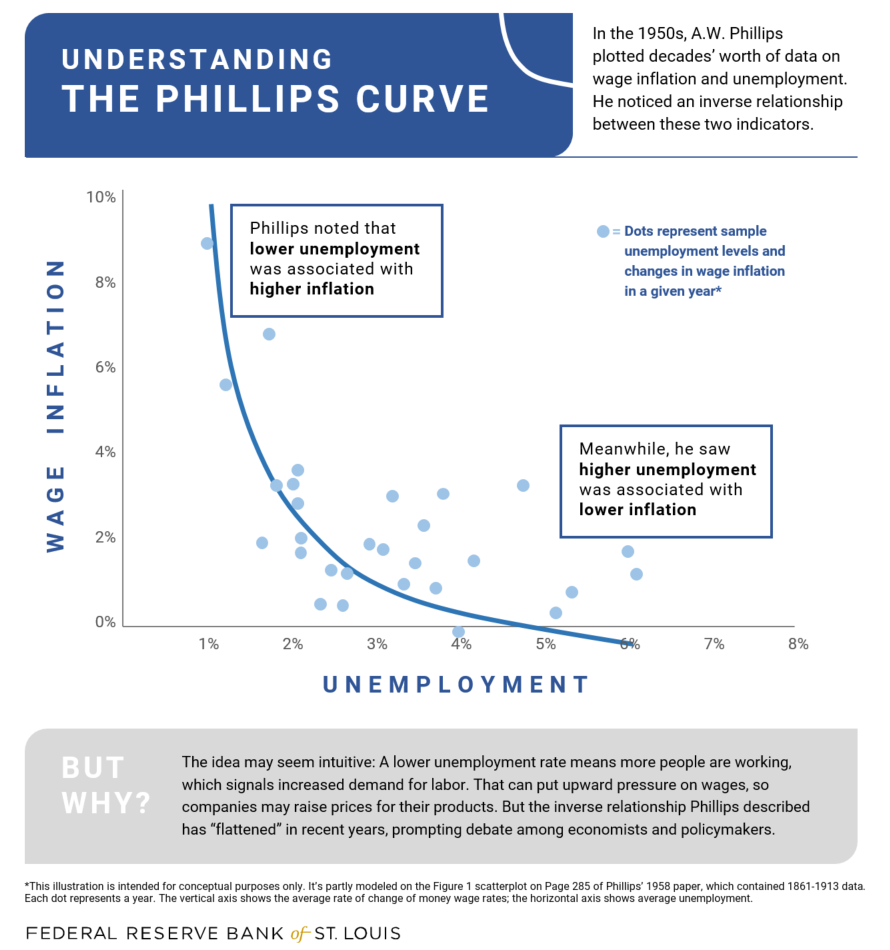

The Phillips Curve shows an inverse relationship between inflation and unemployment. Graphically, it’s a simple representation and a heuristic model between two most critical areas of focus of the central bank.

Reflecting on current monetary policy, one can argue that Phillips Curve is dead. With extreme measures of quantitative easing (QE), near zero interest rates, high unemployment, and large sums of liquidity makes it difficult to argue otherwise.

Modern monetary policy thinking makes the Phillips Curve less relevant for long-term strategies since the curve becomes vertical with inflation increasing over time while unemployment rates are consistent, but the model is fairly relevant for the short term.

The Fed can aim to keep unemployment low forever (theoretically) as long as they’re willing to pay a higher price with inflation. And with inflation on the horizon, Fed’s balance sheet exceeding $7T and ~10M unemployed (at the time of this writing), you can visualize the short term curve being flattened.

We’re living in a time of “Great Monetary Policy Experiment” triggered by COVID-19.

In my opinion, the Phillips Curve isn’t technically dead. Once the vaccine arrives, the Fed will have more control influencing unemployment rate. Their primary challenge until then is controlling inflation.

Just wanted to say this is an awesome explanation, and has helped me a lot in understanding the concept, keep doing what you are doing !

Thankyou!

Thank you!