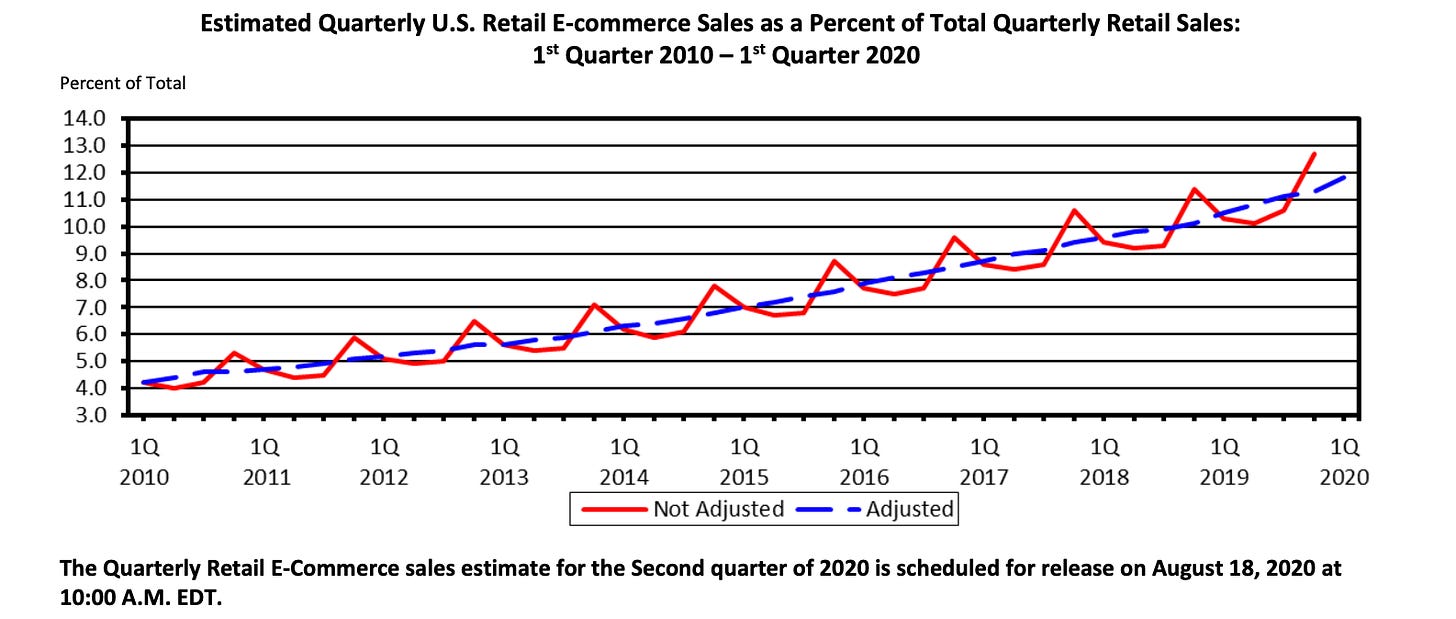

Q1 2020 paved the way for eComm. The latest U.S. Census report shows Q1 eComm was only 11.8% of all retail sales ($160.3B eComm of total $1.36T of all retail sales).

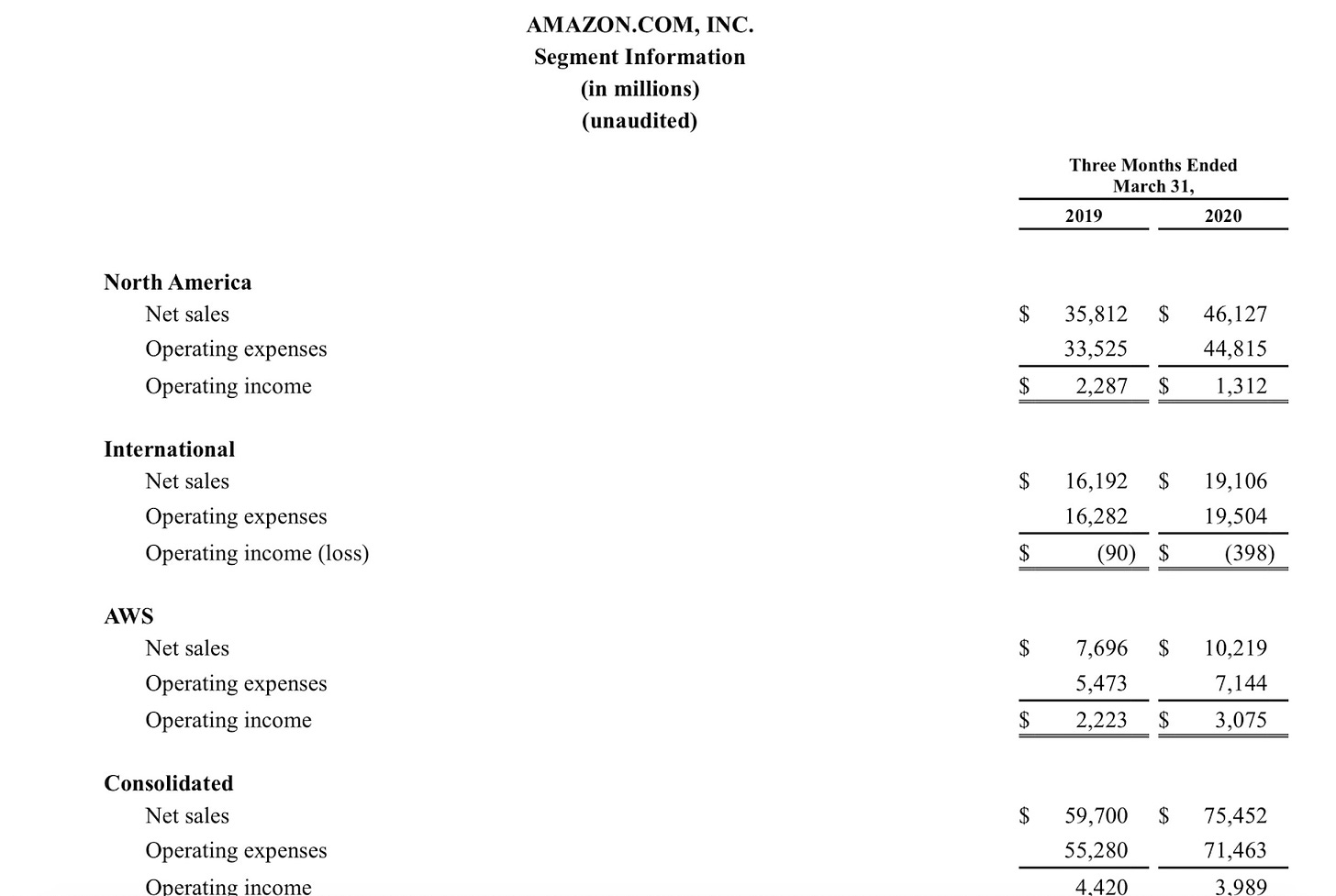

Amazon net sales in North America (excluding AWS business) was ~$46B. Amazon earned ~$21.3M per hour in North America. Amazon is ubiquitous and these numbers are incredible… Perhaps Elon is reading Amazon’s financials in detail and tweeting about it.

… not really. Elon is just upset about Amazon fact checking his upcoming book on COVID-19 and not meeting their guidelines.

Back to eComm. Data suggests that Amazon is 25-30% of all US eComm. This is a strong signal that the long tail effect of independent consumer brands is real.

There are some data sets that don’t exclude AWS and international sales when looking at Amazon’s impact on US retail. Functionally, it’s only 2-3% of all US retail, and it’s clear that Amazon’s business is collectively much bigger than just its eComm arm.

Now, let’s explore the future of eComm. It’s on track to have a record year. COVID-19 isn’t just a change agent; it’s an accelerant for the vertical. Things we were suppose to observe in the next 5 years, we will observe in the next 10 months. It’s paved the way for up starts and incumbents that invested in digital. 11.8% impact noted above is for Q1. COVID became a real thing when countrywide quarantine went into effect in mid-March. We’re more than 70% of the way through Q2 and the world looks and feels much different now than it did in Q1.

I’m expecting Q2 eComm sales to be ~23% of all US retail sales. Some early signals and research is suggesting that it’ll be close to 27-30%. US states opening earlier than expected can influence eComm penetration in the short term.

Let’s zoom in for a moment. I’ve personally observed incredible growth in direct to consumer (DTC) brands over the last 8 weeks. I’m talking 500%+ type growth in top line revenue while maintaining healthy operating margins. The smartest decisions these brands made were tackling inventory constraints earlier in the year and doubling down on marketing.

This spark, however, is not steady-end state. June will be a trying month for many companies and independent brands. It will not look similar to the success seen in April and May. Reasons range from retail opening up, broader employment uncertainty, social unrest… all those things impact consumer behavior.

Amazon’s current guidance suggests that it’ll do $75-81B in Q2 in total sales. All else equals, they’ll likely do $45-51B in net sales in North America (excluding AWS). Which means independent eComm brands will own a much larger share of eComm pie in Q2. Combined impact could be Q4 2019 + Q1 2020 combined.

Dynamic nature of COVID-19 makes forecasting challenging. As we get into earnings season in a few weeks, we will observe many traditional retailers explicitly reporting on their eComm revenue as a % of total sales. This will be an attempt to signal innovation and resiliency. But it should be taken with a grain of salt. E-commerce cannot replace offline revenue for traditional retailers.