“The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap). The Intelligent Investor is a realist who sells to optimists and buys from pessimists.” – Benjamin Graham

By definition, a bear market is when securities fall 20% from their recent high. S&P 500 index entered bear market territory on Friday before having a small rally. All signs point to us entering a bear market for this index this week.

NASDAQ has been in a bear market since March.

I keep thinking about Buffet’s statement: interest rates are to valuations as gravity is to matter.

Rising rates typically crush growth outlook. Whether it’s Coinbase, Netflix, Zoom, or really, any growth-focused securities.

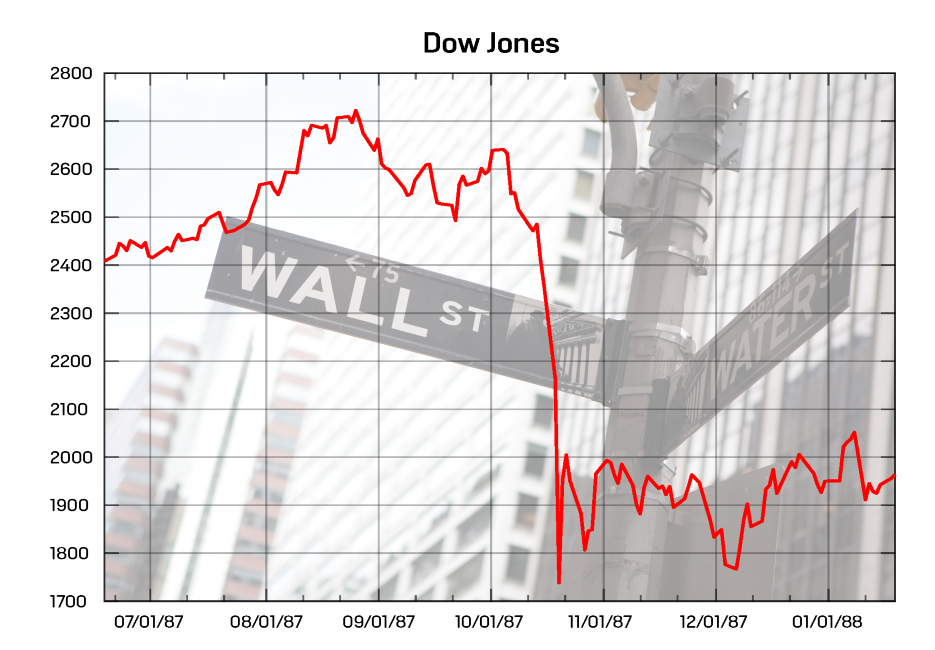

Jim Bullard, St. Louis Fed President, likely saved us from “Black Monday” this week. He spoke at the Energy Infrastructure Council citing that he is expecting above trend growth in the U.S. over the next 18 months, although he acknowledged that there are risks to growth, such as what will happen with the European and Chinese economies. He also noted that U.S. labor markets are strong. Learn more here.

Bullard is the hawkish Fed President. When he speaks, investors listen and markets react.

If you’re unfamiliar with Black Monday: on Oct 19, 1987, the global stock market crashed. At the time, all of the 23 major securities’ markets around the world experienced a sharp decline. Worldwide losses were estimated $1.7 trillion.

We experienced 8th straight week of decline. This is the longest stretch since April 1932. The S&P 500 is trading at at ~16X next year’s earnings, down from 21.5X at the start of this year. Previously, we discussed 3,800 being a bear case for S&P 500. But the sell-off isn’t over and the bear-ish case now is trending towards 3,400.

April CPI data came in at +8.3% over the last 12 months – a strong sign that inflation is here to stay. Also signalling that the Fed will take extreme measures to fight it by raising rates (which would further impact valuations and security pricing).

There’s a lot happening in the market, but if you were to boil it down to key bullets, it would be these three:

- Stagflation – inflation meets stagnation

- Inflation will continue to hurt demand and keep pushing the Fed to raise rates.

- COVID fears and China

- China is on lockdown in an attempt to fight COVID. President Xi is doubling down on “zero COVID” policy.

- Russia-Ukraine war

- Energy, food and commodity prices have been severely impacted.

Remember, the stock market is often a leading indicator of what may happen in the real economy.

Over the coming weeks, we’ll continue to experience volatility (it’s possible that VIX will top 40). During that process, we’ll see small rallies. These moments are called “Dead Cat Bounce.” These will be short-lived. Assuming all else equals, the fundamentals wouldn’t support those rallies.

The only material change that would trigger a positive outlook would be a change in one of the three bullet points above. Russia-Ukraine war coming to an end would significantly reduce energy prices and have a positive impact on food production. COVID lockdown ending in China would quickly improve supply-side to help meet consumer demands. Since inflation – to some extent – is a by-product of these two, we should feel a form of relief.

Time will tell how things pan out.