“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die of euphoria.” – Sir John Templeton

Business confidence and consumer confidence have never felt further apart.

US real GDP contracted by 1.4% in Q1 of 2022 (annualized). Recessionary risk went from being inevitable to imminent.

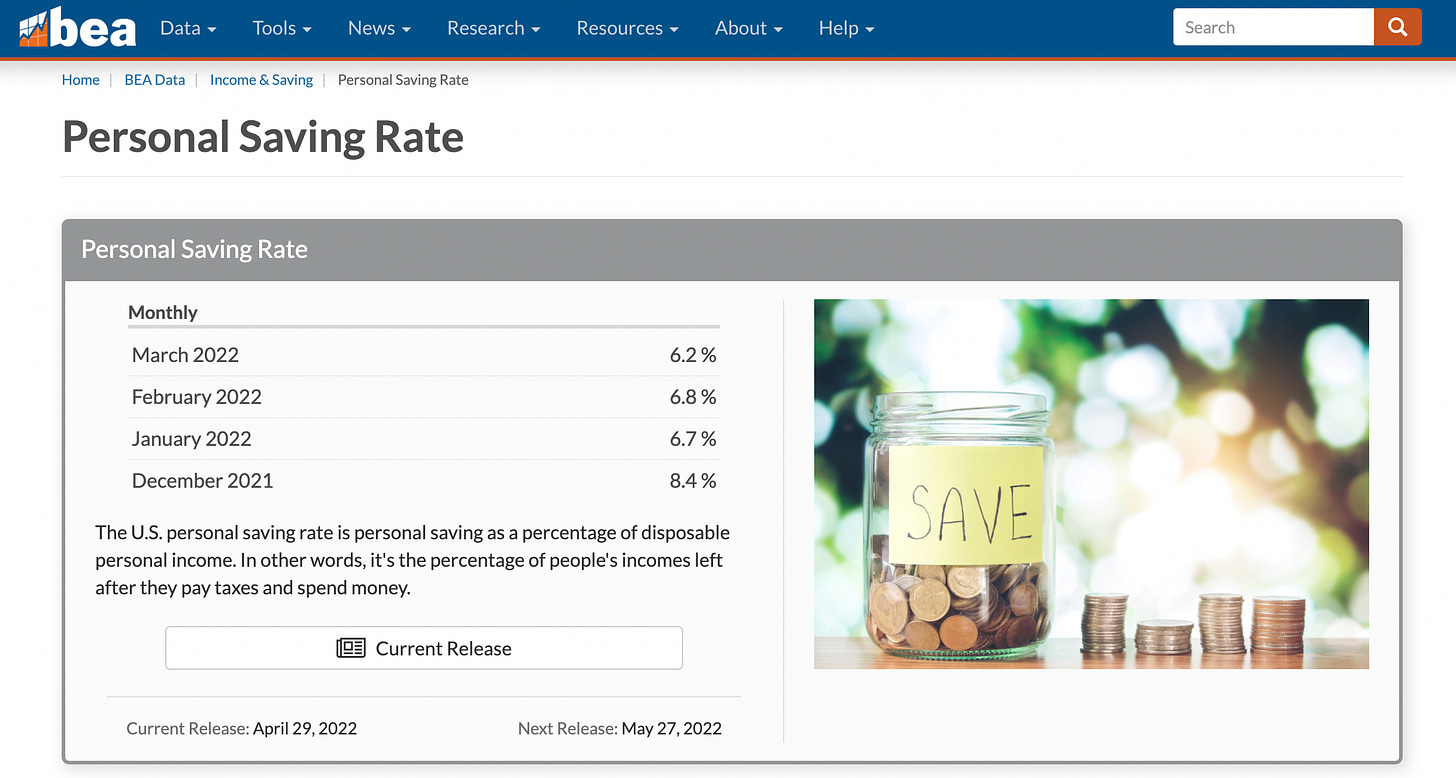

Meanwhile, the jobs report came back last week better than expected with a 3.6% unemployment rate. And the consumer demand is stronger than ever with savings rate continuing to drop.

So, given the strength in consumer demand, what’s causing the markets to rattle?

Variables Impacting Capital Markets

There are a lot of things at play. Some positive, some concerning:

Positives:

- The Fed is out of the way (for now). No more speculation of 75 bps interest rate hike. Fed has confirmed 50 bps rate hike and are strongly leaning towards this rate for the next few meetings. This is a net-positive for investors. It signals that the Fed believes they can find a soft landing against inflation.

- Jobs report came back positive

- Consumer demand remains strong

Challenges:

- China’s zero-COVID policy is hurting supply side

- Inflation is still a major concern

- Recession fears have moved up from 2023 to 2022

- Unemployment rise in a recessionary environment; shrinking consumer confidence

- Rising rate forces all assets to be re-priced

No one can predict the market, but it shouldn’t surprise us to see S&P500 fall to 3,800 levels before finding it’s footing.

As with any investing, it all comes down to discipline and your time horizon. If your time horizon is 10+ years, then the next few months might be a buying opportunity.

Now, the main event:

How Can Entrepreneurs Prep For a Recession?

Last time we experienced a real recession was 2008-2009. It’s been a tremendous 12 year bull-run. Historically, we’ve seen recessions kick in every 7-8 years. So, naturally, we’re overdue for one.

Recessions are a healthy part of a functioning economy. The best companies are often started and built during a recession. Here are some notable companies built in the last recession:

Dropbox, 2007

Airbnb, 2008

Cloudera, 2008

Groupon, 2008

WhatsApp, 2009

Venmo, 2009

Uber, 2009

Slack, 2009

Square, 2009

Instagram, 2010

Pinterest, 2010

These are just a handful of “decacorn” examples. There are plenty of other private companies that were started and built during hard times.

Why am I sharing this? Because…

Abundance is hard to manage. Scarcity is a blessing when leveraged properly.

Venture Capital

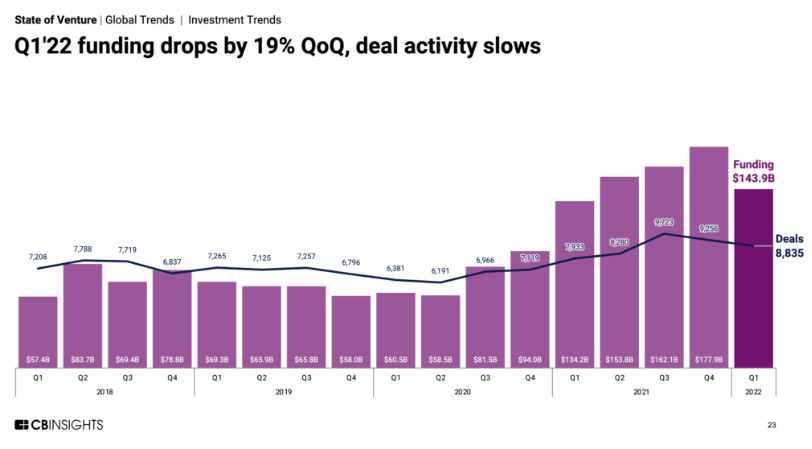

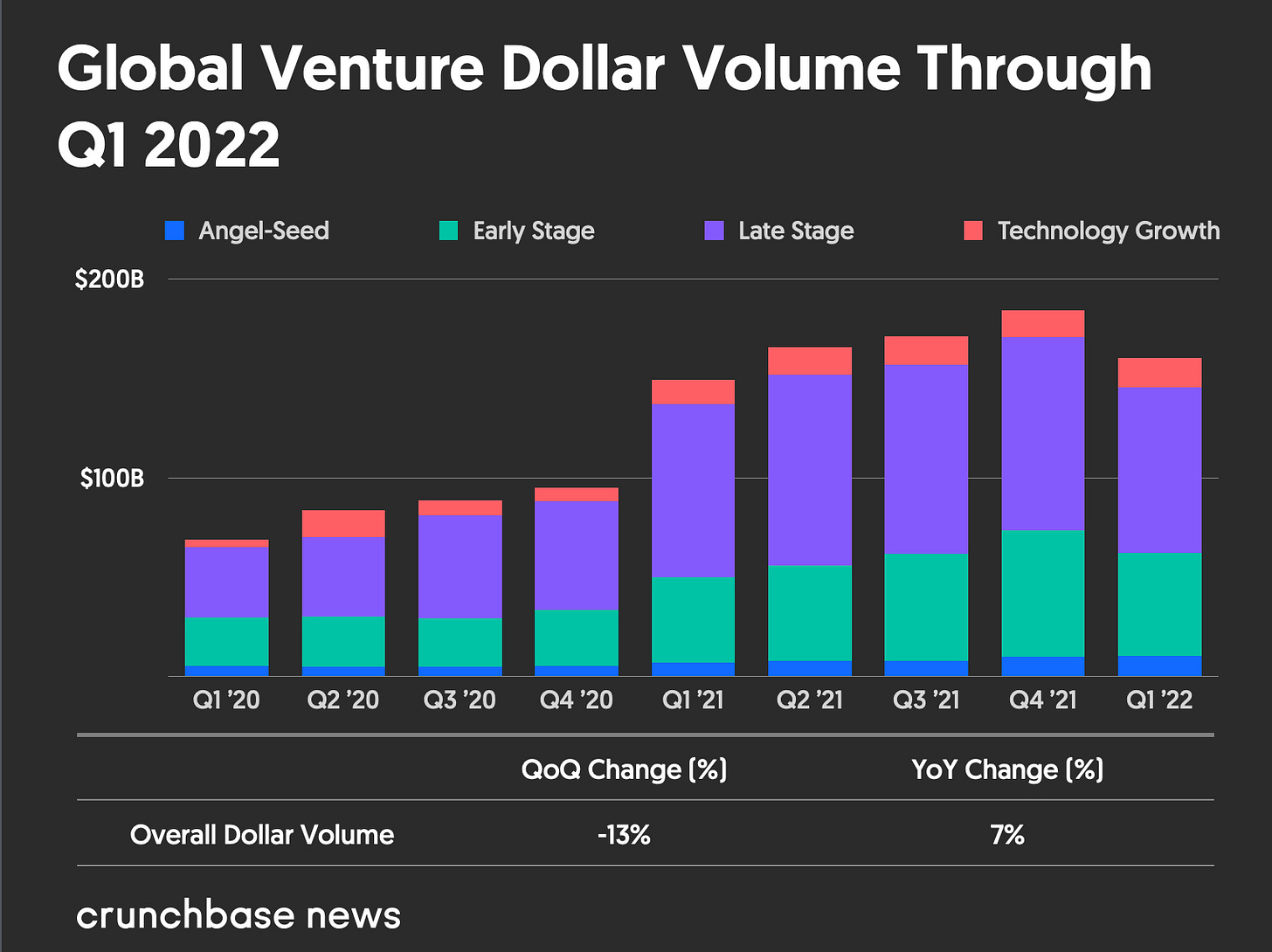

Days of sky-high and unrealistic valuations are coming to an end. Companies will raise less money at appropriate valuations. We’re already seeing a compression in deals getting done in venture capital.

Naturally, later stage companies will feel the greatest impact. As public market securities get re-priced, late stage and “technology growth” companies will feel a compression in their growth outlook and as a result, valuation and operations.

If you’re venture-backed, look at your runway and optimize your burn. Only allocate resources to activities that generate revenue. Be relentless about capital allocation. Focus your management meetings and board meetings on activities and operational metrics that positively influence your top line. And if you’re later stage, think about operational metrics that bring you closer to profitability and FCF.

Reality is that late stage startups are compared to their public market counterparts. Often, large startups are too big for M&A. So, going public remains the only option. Investors in public markets reward companies that are profitable and FCF positive in a rising interest rates environment. Burning cash to drive growth is never favored when interest rates rise.

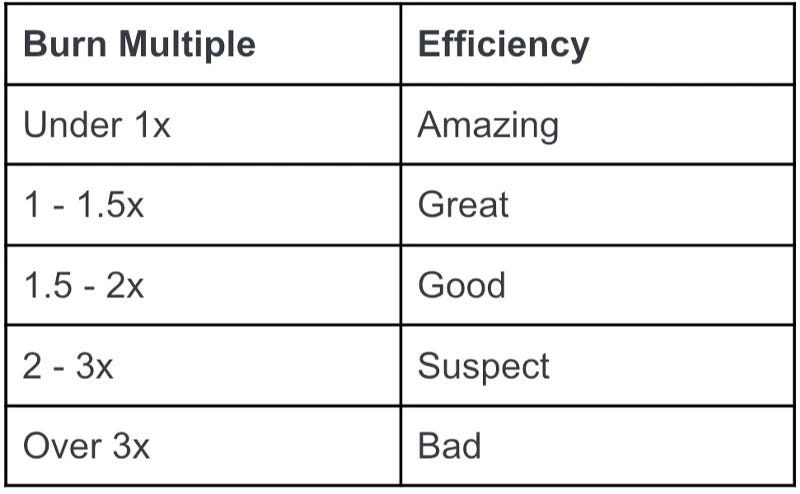

David Sacks has a great article on “The Burn Multiple.” Recommended read for every entrepreneur.

Bootstrapped

If you’re private company and bootstrapped, then goal is to optimize for profitable growth. Depending on the size and scale of your business, you may or may not have a board, debt financing, distributed teams, etc. So, if you’re running a business that’s doing < $25M in revenue, here are things to consider:

Note: some of the lessons below are also relevant to VC-backed companies.

- Establish a smart board of advisors

- These are individuals with relevant experience to help you build a great business. 3-5 people max. Have monthly 1-1s with them. Compensate them accordingly; either with some equity upside or cash. Some folks will do it for free because they just want to support you.

- Establish your tribe

- Life is a team sport. But entrepreneurship can feel lonely. You’re not the only person wrestling with iOS 14.5 challenges or having supply chain issues or staffing challenges, etc. Join FB groups / discords / slack channels / local organizations, so you can share lessons and experiences while learning from others that are on the same journey.

- Establish a line of credit (LOC), if you haven’t already

- Most larger SMBs have this already. Businesses typically doing less than $5M don’t. Explore both secured and unsecured LOCs. Talk to your bank about establishing an LOC. Treat it like a rainy day fund. You probably won’t need it if you’re FCF positive and building a healthy (profitable) business. I won’t go deep here since this is an essay topic on it’s own. Learn more here.

- Review your financial reporting with your CFO frequently

- Financial reporting (income statement, balance sheet, and cash flow statement) reveals a ton of data that enables you to make strategic decisions ahead.

- If you don’t have a CFO, hire a fractional/strategic CFO to help you here. It’s a small investment that pays dividends.

- Review your forecasts with your CFO and management team weekly

- SMBs often don’t forecast growth. In fact, most entrepreneurs are too focused on today and next week. Hardly do they have the bandwidth to zoom out and think about next year and beyond.

- Build an operating model and forecast out a certain number of years. Allow yourself to see the big picture. Your goal might be to sell your business 24 months down the line. Or you might look to bolt on and acquire other companies. Decisions you make today can influence your terminal value.

- Focus on cash flow

- I can’t emphasize this enough. Review your books (see above), triple check your payables, accelerate your receivables, build strong lending relationships and stay in close communication, negotiate longer payment terms. Optimize your cash conversion cycle.

- Don’t stop marketing

- You may have an itch to pause marketing efforts because of a few bad performance marketing days. Use those as lessons learned and improve on what’s not working. Certainly, pull back budgets if performance isn’t there. Make your agency partner and creative group work harder to find results. Do more CRO, send more emails, explore running promos, etc. But don’t stop marketing.

- Focus efforts on “hero products.” Your core products, not experiments. These are tried and true and you have retention data to prove it.

- Invest in retention

- During a recession, consumer demand compresses. New customer acquisition becomes harder. Invest in existing customers. Surprise and delight them. You already have a “trusting relationship” with them. This is true for both service providers and product-based companies.

List goes on and on.

Do You Need Help?

I’m opening up my calendar starting next week to do a few 30 min calls with entrepreneurs (whether you’re VC-backed or bootstrapped) and help you with any questions you might be wrestling with or challenges you’re trying to overcome. Goal is to make you part of my tribe and for me to join yours.

In the meantime, invest wisely and keep building!