“Be fearful when others are greedy. Be greedy when others are fearful.” – Warren Buffet

Stocks fell sharply last week and beginning of this week.

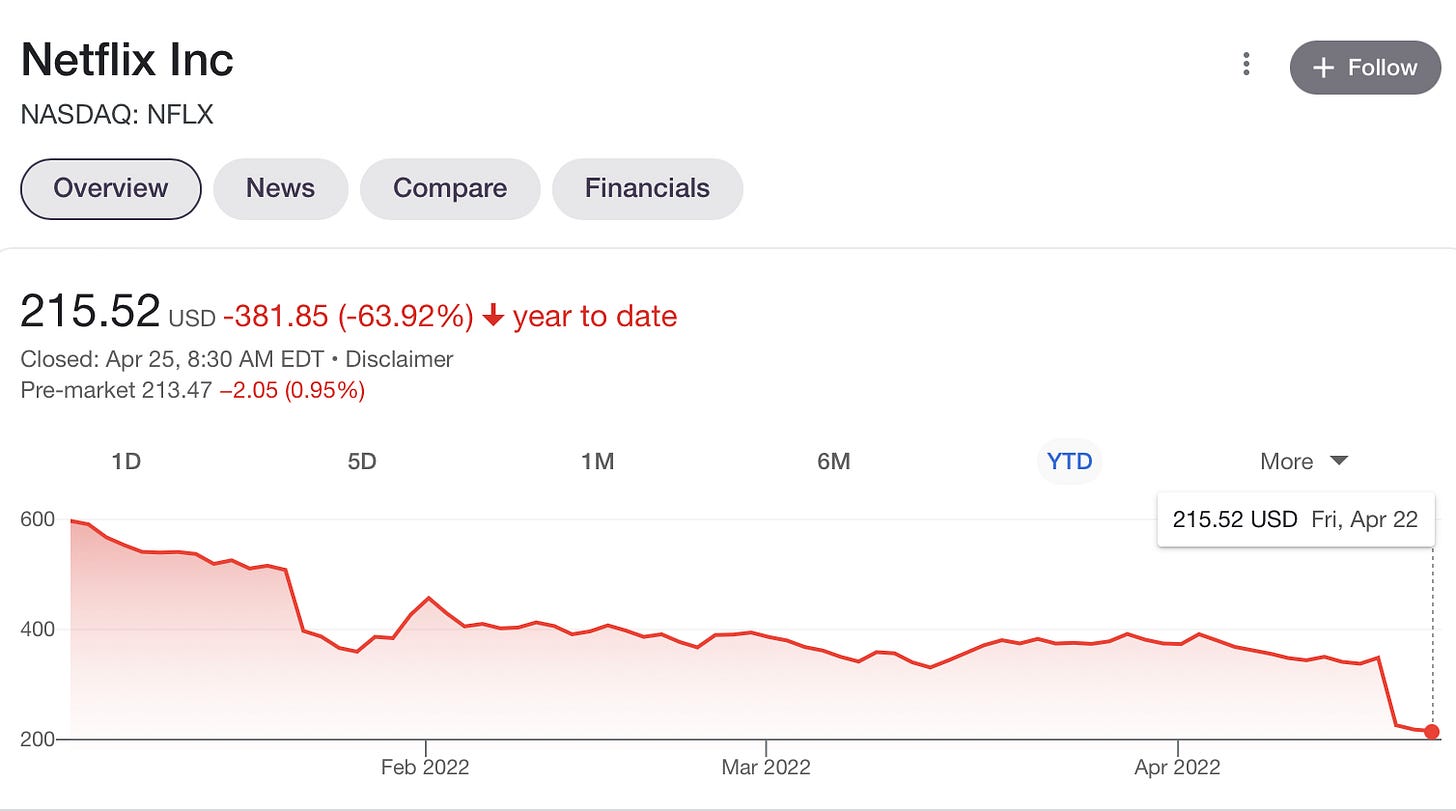

Netflix shocked the market with its earnings and outlook. This impacted Meta, Disney and other media companies.

Asset classes across every sector are being re-priced after the Fed chair, Jerome Powell, suggested 0.5% interest rate rise being on the table starting next month. And future FOMC meetings will likely follow 0.5-0.75% rate hikes. With end of year terminal target of 3.0-3.5%.

This is a moving target as the Fed wrestles with soaring inflation… the market seems to be playing chicken with Fed guidance.

Interest rate sensitivity isn’t new. Capital markets have gotten used to expansionary monetary policy.

If the Fed’s job is to instill confidence in controlling inflation, then that confidence might be fading.

For context: The Fed cannot control supply. It can, however, influence demand.

Will the Fed compress demand to control inflation?

Short answer: yes.

But it’s hard and requires thoughtful considerations to not trigger a recession.

Interest rate hikes are a great way to reduce demand for certain assets and products. Practically, anything that requires financing is impacted. Mortgage rates and car sales are directly impacted. Since both homes and cars are commodity intensive products (requires lumber, steel, aluminum, etc), we see the demand curve influencing supply side.

The Fed can help the supply side reach equilibrium by compressing demand.

There are a few macro trends to keep an eye on as we look ahead into this week:

- China’s zero COVID policy and its impact on supply chain

- Fed’s interest rate and its impact on markets

- Q1 earnings

Apple, Alphabet, Meta, Coca-Cola, and Microsoft all report on their earnings this week. Dozens of other companies are reporting as well.

I’ve been speaking 1:1 with a few individual investors that manage their own portfolio and they’re actively buying index funds and steering clear from individual securities in this market environment. They’re smart investors yet struggling to underwrite companies with inflation rising. (This is not investment advice).

The market can certainly use an earnings boost this week to rally around stagflation fears. The Fed raising rates should be priced in by now, according to Jim Bullard from St. Louis Fed. A lot will lean on earnings and guidance from mega cap and bluechip companies to dictate how the market will react.