“Inflation is taxation without legislation.” – Milton Friedman

Inflation, by definition, is too much money chasing too few goods.

You’re feeling the pain at gas stations, grocery stores, and restaurant bills. Everything is feeling expensive. How did we get here?

The Fed has two jobs: to achieve price stability and target max employment. Historically, price stability comes at modest growth levels of 2% inflation. We’re at 7.9% for Feb with March data expected to come out this morning. Labor market is overheating and unemployment is as low as it can be at 3.6%.

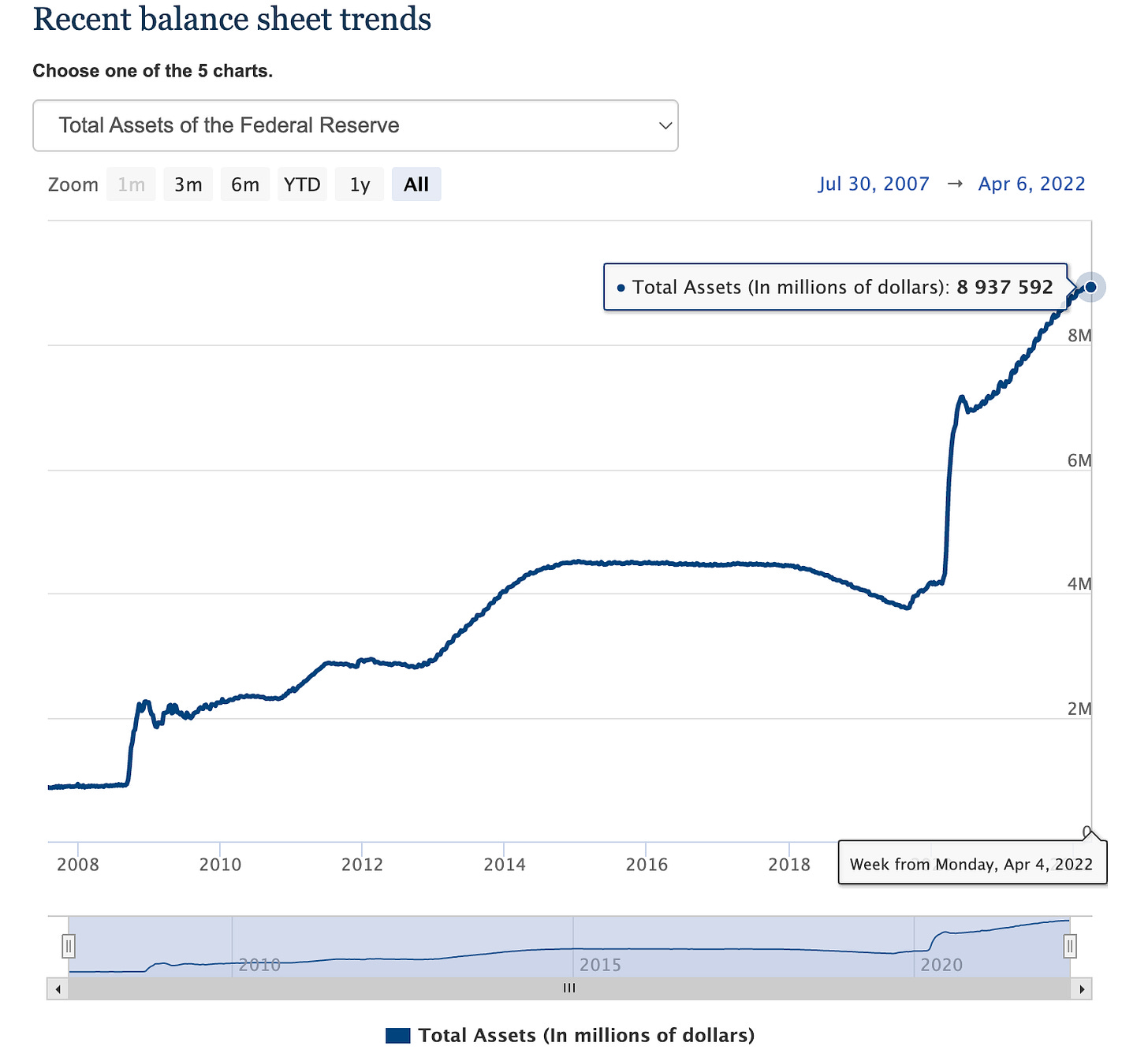

The Fed overestimated the impact of COVID and probably didn’t expect the fast bounce back in a form of “v-shaped recovery.” As a result, they loosened monetary policy by reducing interest rates to functionally zero and padded their balance sheet up to ~$9T.

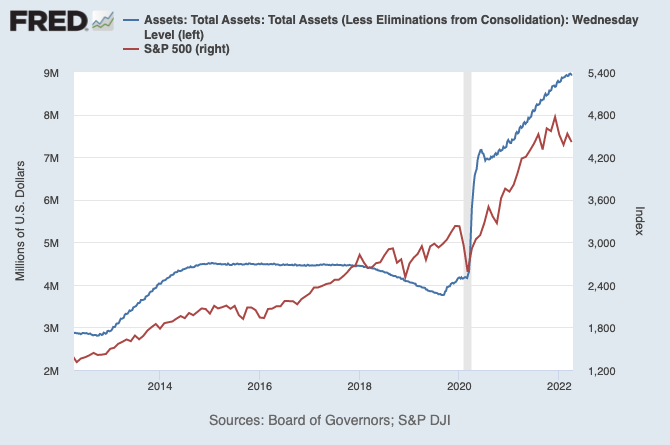

The massive liquidity led to asset price inflation. Everything from stock prices to crypto spiked in value. Fiscal policy was also very accommodative with stimulus checks amongst other forms of help.

COVID prevented consumer spending on services and over-indexed spending on goods. Due to a host of supply issues and challenges with “just-in-time” manufacturing, we experienced supply constraints like never before. Because COVID isn’t a localized problem, it impacts everyone. Factory shutdown in Shanghai will impact product delivery in Austin, TX. Chip shortages in Taiwan will increase the price of your car in Denver, CO. And so on.

These are natural problems in a globalized system and free market capitalism. But markets have a tendency to course-correct themselves.

The problem is that markets have become too reliant on expansionary monetary policy.

Notice a correlation between S&P 500 and assets of the Fed?

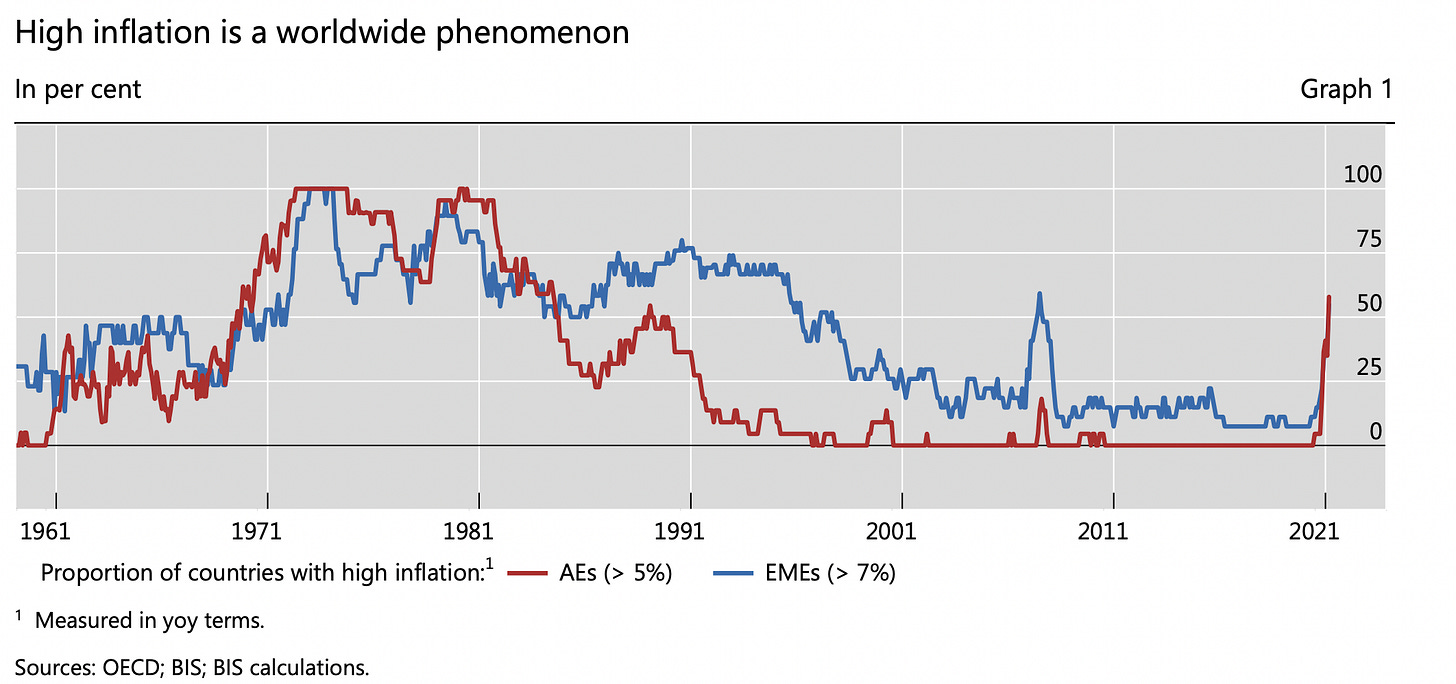

The Fed struggled for 10 years to get inflation back on track. Now, it has the opposite problem. Our view of inflation needs to evolve. In a globalized system, there are “price spill overs.” Things don’t operate in a vacuum. Inflationary pressures in one sector inevitably impact other sectors.

Understanding inflation isn’t always clear-cut. And we all have the gift of hindsight.

History can provide context. It can teach us lessons. But it’s not prescriptive to future events.

Inflation is now 5%+ in 58% of developed economies and 7%+ in 55% of emerging economies. Energy might be a topic of discussion, but it isn’t the only problem.

Food prices have soared 12%+ from Feb to March. This is important because food costs account for 17% of consumer spending in advanced economics and 40% in smaller economies. Higher food prices in poorer countries can lead to political instability and other problems.

So, What’s Ahead?

Monetary policy focus has shifted to “neutral.” Meaning, The Fed isn’t looking to expand nor slow growth. With inflation being a focal point in every meeting, Fed will look to tame inflation by increasing rates (now targeting 3.00% end of year) and reduce its balance sheet by $95B per month. And it shouldn’t surprise us if Fed aims to push rate hikes to 4% if inflation isn’t in control soon.

As an enduring investor, you know that a rising interest rate environment and tighter monetary policy isn’t favorable to certain sectors. Tech, in particular, feels the hardest impact. We saw NASDAQ falling last week on this news. We’ll continue to experience volatility in the short term as the Fed aims for a soft landing.