“Quarterly earnings are a function of the weather for many companies; commodity pricing, competitor price changes, volumes, etc. all impact the business in the short term.” – Jamie Dimon

Short term thinking yields knee-jerk reactions to micro and macro events in life. It creates zero sum games between people, minimizes long term value creation and amplifies corner-cutting.

It focuses on today and tomorrow, not on 5-10-20 year horizons. As a result, a bank may not open up a new branch, a clothing company may cut its marketing budget or heavy up on promotions, a restaurant may reduce kitchen staff, a technology company may not invest in R&D, and so on. All of those actions improve the bottom line but are net-negative for long term health and growth of the business.

Warren Buffet is not the greatest investor. Jim Simons from Renaissance Technologies takes the throne there. Jim has achieved 66% gross annual returns (before fees) since 1988 (and trading gains in excess of $100 billion). Stan Druckenmiller is up there as one of the greatest.

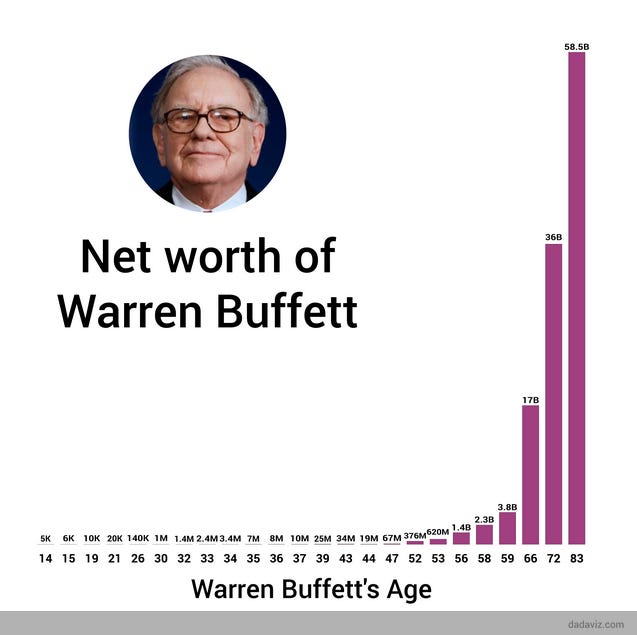

What Buffet has going for him is time and consistency. His returns are good, but not superior to other investors. Consistency to buy when others are fearful and allowing that growth to compound with time is Buffet’s secret sauce.

More than 99% of Buffet’s net worth was generated after the age of 50. He buys businesses that he can hold onto (theoretically) forever. He doesn’t focus on quarterly forecasts set by Wall Street. As Jamie Dimon would say, quarterly forecasts are a function of the weather. Buffet lives by that principle.

We’re in a late cycle economy now. With impending recessionary risk in 2022 or 2023, inflationary pressures, and price shock in commodities. Even though the consumer base in strong, these pressures will compress demand.

In late cycle markets, we’ve historically seen investors flock to earnings stability and operational efficiency when buying securities. Sectors like energy, utilities, healthcare and consumer staples can do well.

In a rising interest rate environment, tech and growth stocks don’t perform as well; albeit this latest rally in tech is a head scratcher. Either it’s “dead cat bounce” or perhaps institutional exhaustion.

Regardless of market cycles, an average investor should focus on long term success versus short term gains. Allow time and consistency to work for you like it has for Buffet. Buying individual securities can be risky, so when in doubt, just buy low cost index funds and allow it to compound on your behalf.