“In the short term, the stock market is a voting machine; in the long term, it’s a weighing machine. – Benjamin Graham

We’re settling into a new world; a transition from “free money” to “cheap money.” But cheap is feeling expensive.

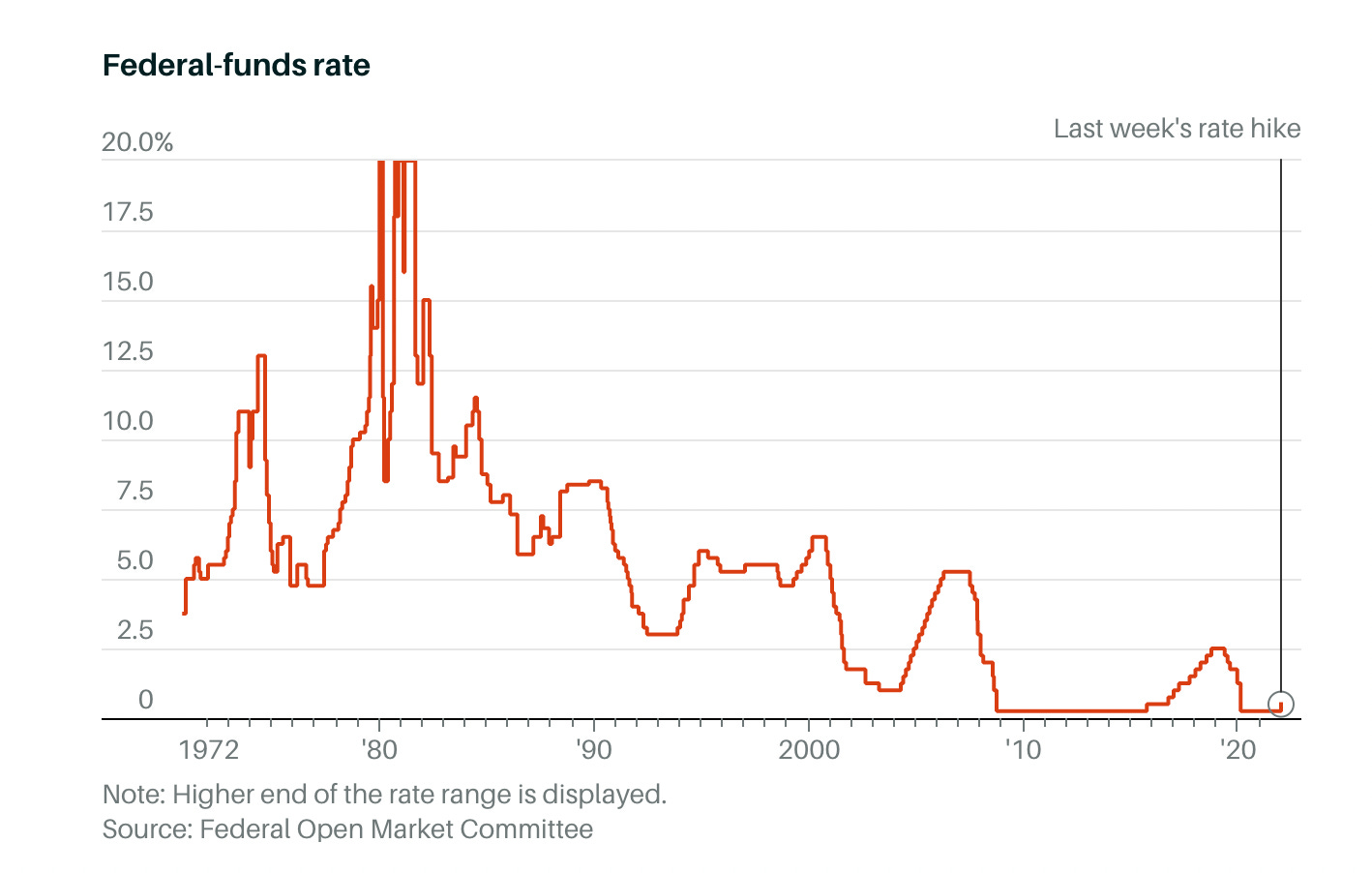

The Fed announced a rate hike of 0.25% two weeks ago. Word on the street is the next hike will be 0.50%. Citi Bank is projecting four 50 bps rate hikes consecutively. With end of year expectation now 2.5-2.75%. And 3.0-3.5% in 2023. It could be higher.

This is important.

Fun fact: The Fed has increased and reduced interest rates 184 times since 1970.

The Fed is fighting an uphill battle. With inflationary pressures continuing to uptick, raising rates is a key tool in the toolbox to fight inflation.

Raising rates has tradeoffs, however. When rates go up, borrowing money becomes more expensive; which encourages companies to borrow less, invest less, and save more. This impacts growth.

I wrote last week about stagflation, and how moving too fast is a problem and not moving fast enough is a problem. The Fed has to thread the needle and find a soft landing to prevent a recession. Which feels inevitable right now.

What does this mean for investors?

Over the short term, more volatility. Over the long run, steady state? The market will eventually settle into the new environment. Certainly, the gains we experienced in 2020 and 2021 for S&P500 won’t be a reality, but investors can probably expect a regression back to the mean of 8% annual returns (with some blips along the way). Consider this the risk free rate of return in the equity markets.

Here’s a great chart of the last 90 years of S&P 500 return. The Y-axis adjusts as numbers increase.

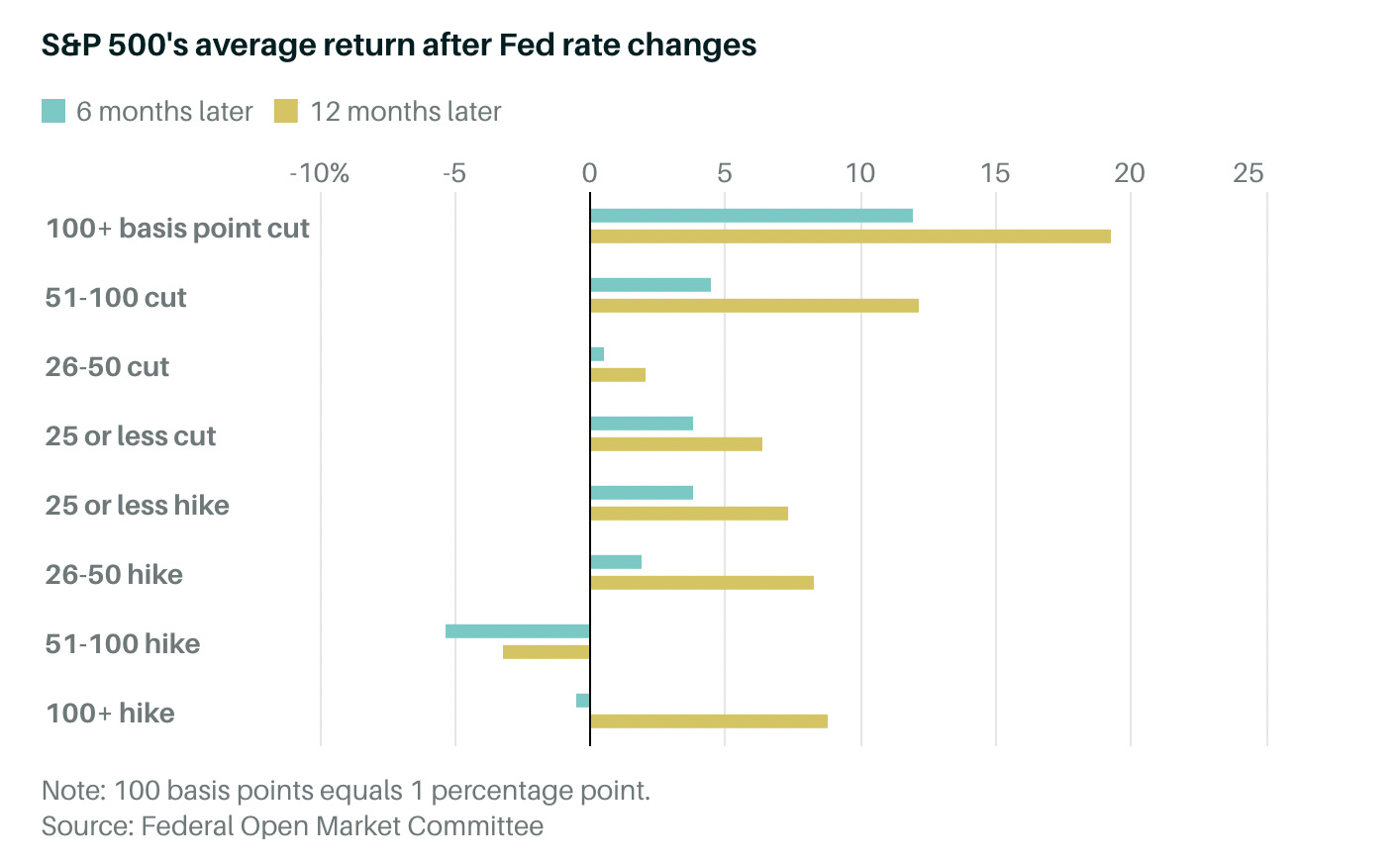

And here’s another great visual of what happens when Fed increases interest rates and market reaction.

There’s more certainty in Fed policy looking ahead now that labor market is strong and inflation is a deterministic problem. The likelihood of a 75-100 bps hike at any one time is unlikely in 2022. We can probably expect 50 bps hike consecutively a few times.

Why should you pay attention to the macro-environment?

Interest rates in the United States averaged 5.45% from 1971 until 2022, reaching an all time high of 20% in March of 1980 and a record low of 0.25% in December of 2008.

Over the last decade or so, the markets have operated in a relatively low interest rate environment. Investors can invest in high growth companies with forward looking (or eventual profitability) and do well with high valuation at current rounds (because future rounds would be higher). That’s not going to the be case looking ahead in a rising rates environment.

Whether you’re an operator or investor, macro-economics matters. How interest rates and inflation behave influences the mechanics of your business (if you’re an operator) and portfolio (if you’re an investor).

In a rising rates environment, operators should be nimble. When debt becomes more expensive, speculative behavior from investors come down and valuations are impacted.

Amazon’s Letter

Jeff Bezos wrote a letter to his shareholders 20 years ago. Amazon shares were down 80% year over year. But Amazon was a better company than it was a year before.

Here’s Page 1 of what Bezos shared.