“Most of us spend too much time on the last 24-hours and too little on the last 6,000 years.” – Will Durant

In February, inflation clocked in at a 40-year high.

Last week, capital markets made a U-turn and gained some upward momentum. Few reasons why this happened:

- The Fed confirmed a 0.25% rate hike (any kind of confirmation is good news)

- Russia-Ukraine crisis is likely priced in for now (as the market looks forward)

- Consumer demand is strong and labor markets are humming

Generally speaking, markets can price in good and bad news accordingly. It’s the uncertainty that causes investors to panic.

Speaking of uncertainty, investors are concerned about a host of things:

- Possible recession during an inflationary period (i.e. stagflation)

- COVID lockdowns in China and it’s impact on oil amongst other commodities

- Crisis in China’s property market. Learn more

- Possibility of yield curve inversion

- Price shock in commodities

- Even tighter monetary policy and Fed’s credibility

In last week’s letter, I wrote about recession being on the horizon and captured specifics on the bottom three bullet points.

For this letter, I want to focus our energy on stagflation.

Simply put, stagflation is “stagnation” meeting “inflation.” It’s when we see slow growth + high unemployment and rising prices.

Historically, economists believed stagflation wasn’t possible because unemployment and inflation have an inverse relationship.

Back in Nov 2020, I wrote a short essay on The Phillips Curve. I talked about asset price inflation in 2020 and predicted spike in CPI in 2021 and 2022. That’s when we were knee deep in the pandemic. The Fed has done a good job controlling for unemployment, but not inflation.

So, why is this important and why are we concerned now?

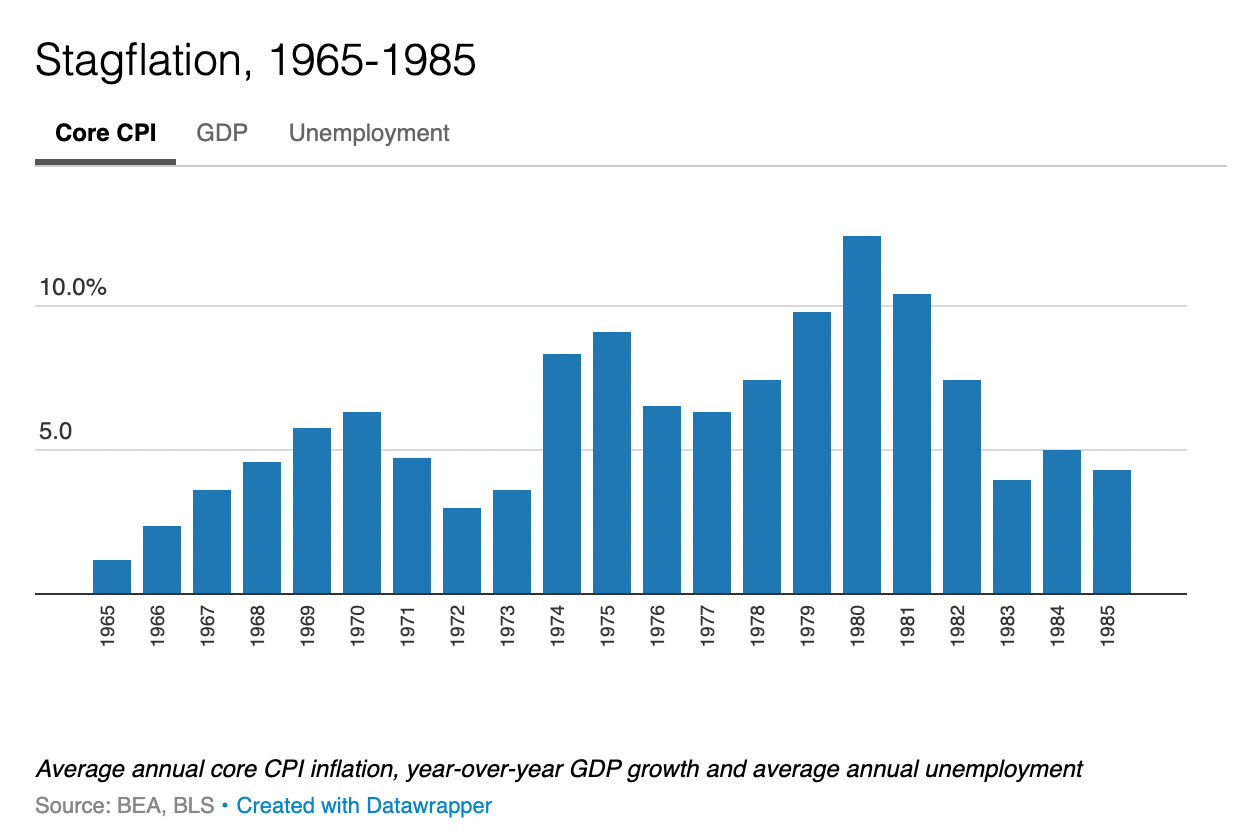

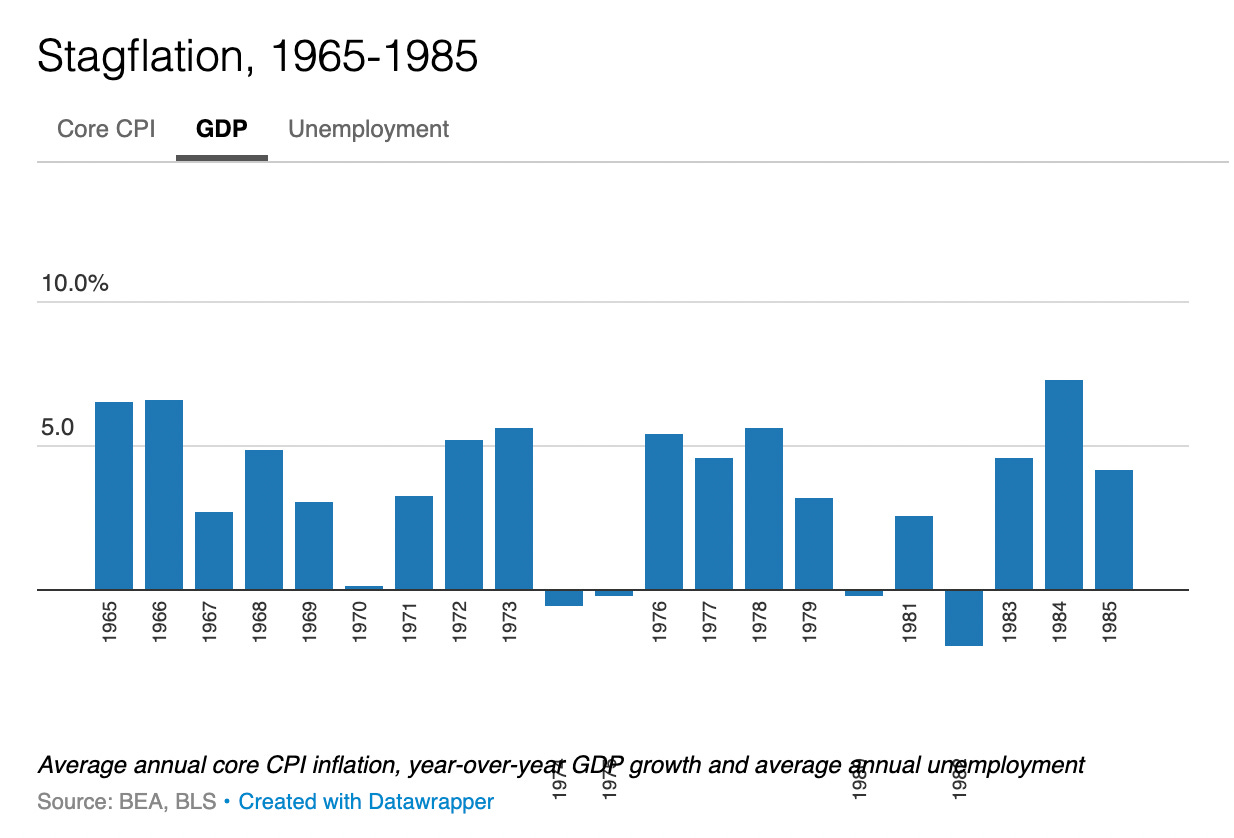

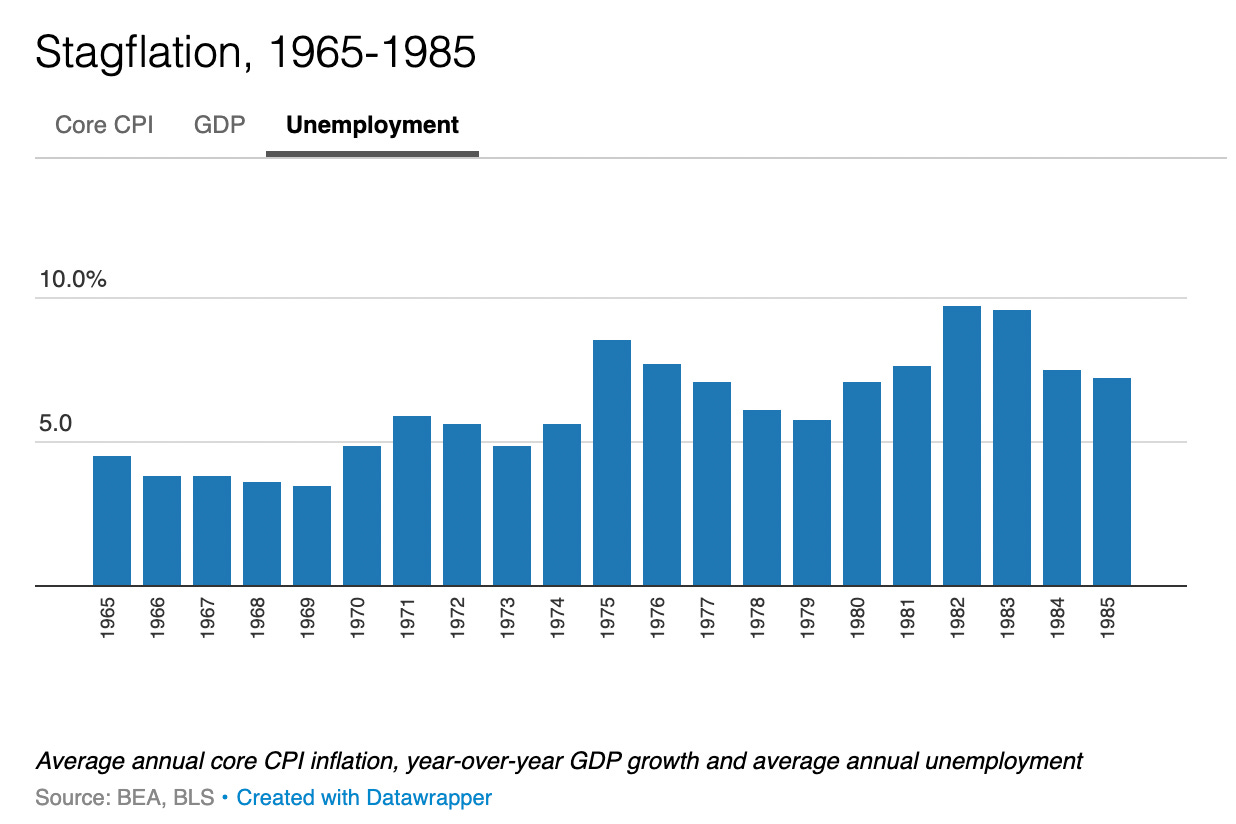

Last time we experienced stagflation was in 1970s. Visually, here’s what it looked like.

Notice the spike in CPI, reduction in GDP and increase in unemployment?

We don’t know if we’ll experience stagflation this year or next, but it’s a concern right now. The Fed is tightening amidst Russia-Ukraine crisis, volatile capital markets, and massive price instability. Jerome Powell and team have a difficult job ahead.

Powell has previously said that inflation is being impacted by supply chain constraints. It’s been amplified since the war started. If supply constraints are impacting inflation materially, then the only way to stabilize prices is by reducing demand.