The world breaks ever decade or so.

Morgan Housel recently wrote about a “shock cycle” for all big news events:

- Assume good news is permanent.

- Oblivious to bad news.

- Ignore bad news.

- Deny bad news.

- Panic at bad news.

- Accept bad news.

- Assume bad news is permanent.

- Ignore good news.

- Deny good news.

- Accept good news.

- Assume good news is permanent.

We don’t know where we are in the cycle until after the fact.

Remember COVID in March and April of 2020? How do you feel about it in March of 2022? The obvious bad news 2 years ago doesn’t seem so bad 2 years later.

Recessionary Pressures

In 1939, John Templeton took a major chance. WWII had just started in Europe and was causing uncertainty in the markets. Templeton saw low prices and borrowed thousands to buy 100 shares of every stock selling for less than $1. Even when 1/3 of the companies faced bankruptcy, he held on to his shares. All but 4 of the stocks rebounded, making nearly a 400% return in just 4 years.

Things only got worse after 1939. Battle of France 1940, Pearl Harbor 1941, Hiroshima 1945…

John Templeton went on to become an incredibly successful investor. He 4X’d his money during the most volatile, uncertain and tumultuous time in modern history.

Every great investor is intellectually curious, patient, disciplined and skeptical. They think through edge cases. They’re not headline readers, they underwrite their own opportunities and think independently.

Right after recovering from COVID, we’re now at the brink of a recession.

What causes recessionary risk?

Generally speaking, one of three things can cause a recession:

- Inverted yield curve

- Price shock in commodities

- Monetary policy tightening

Right now, there’s potential for all three to happen at the same time.

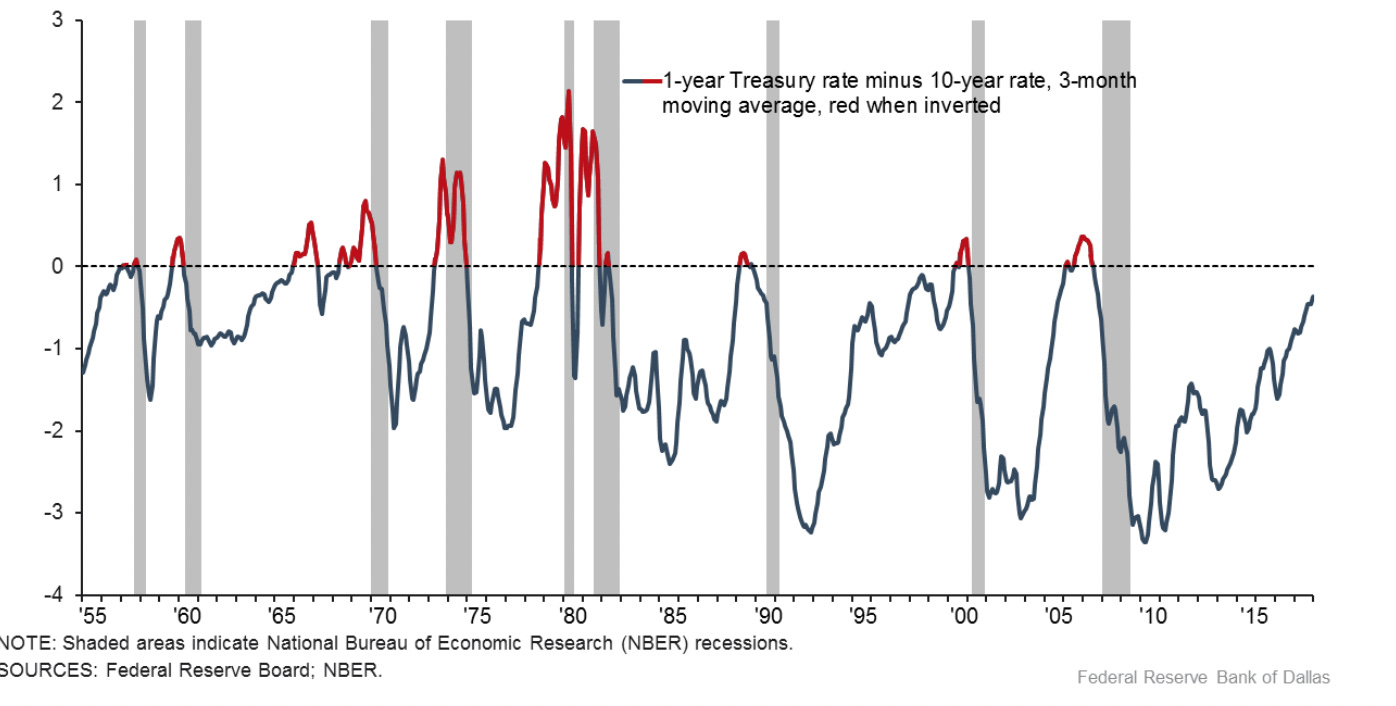

Yield Curve Inversion

If you’re curious: an inverted yield curve is when short term U.S. Treasury pays high interest rate than longer term yields.

St.Louis Fed has a great post on this here.

This is important. Yield curve inversions have been a reliable recession indicator.

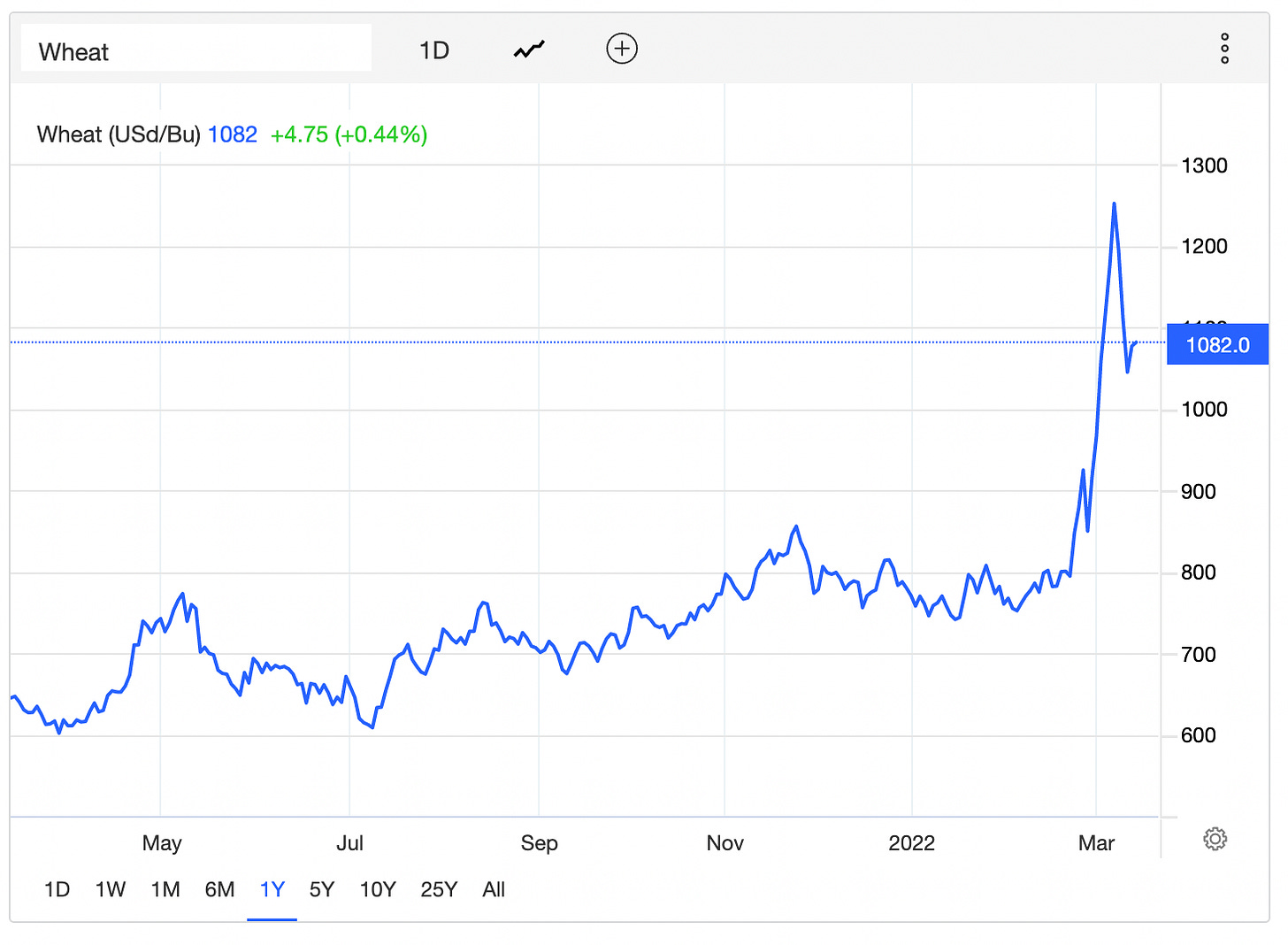

Price Shock In Commodities

Second issue is price shock in commodities. We observed this starting in 2021 (e.g. lumber for home building), but those were demand fulfillment issues with low interest rates, large domestic migrations due to remote work spike combined with labor shortage. Today, we’re wrestling with enormous supply-side challenges. International conflicts don’t help this cause and globalization has trade-offs.

At the time of this writing, price per barrel of crude oil is $100+. This impacts every part of logistics, transportation and beyond.

Thinking beyond just oil… price of raw materials have gone up, there’s a growing demand for goods, China has a declined production capacity, and more. These compressions lead to increasing inflationary pressures and weakens consumer demand.

Here’s a good example: wheat. Price of pizza will likely go up or you’ll get less of what you pay for.

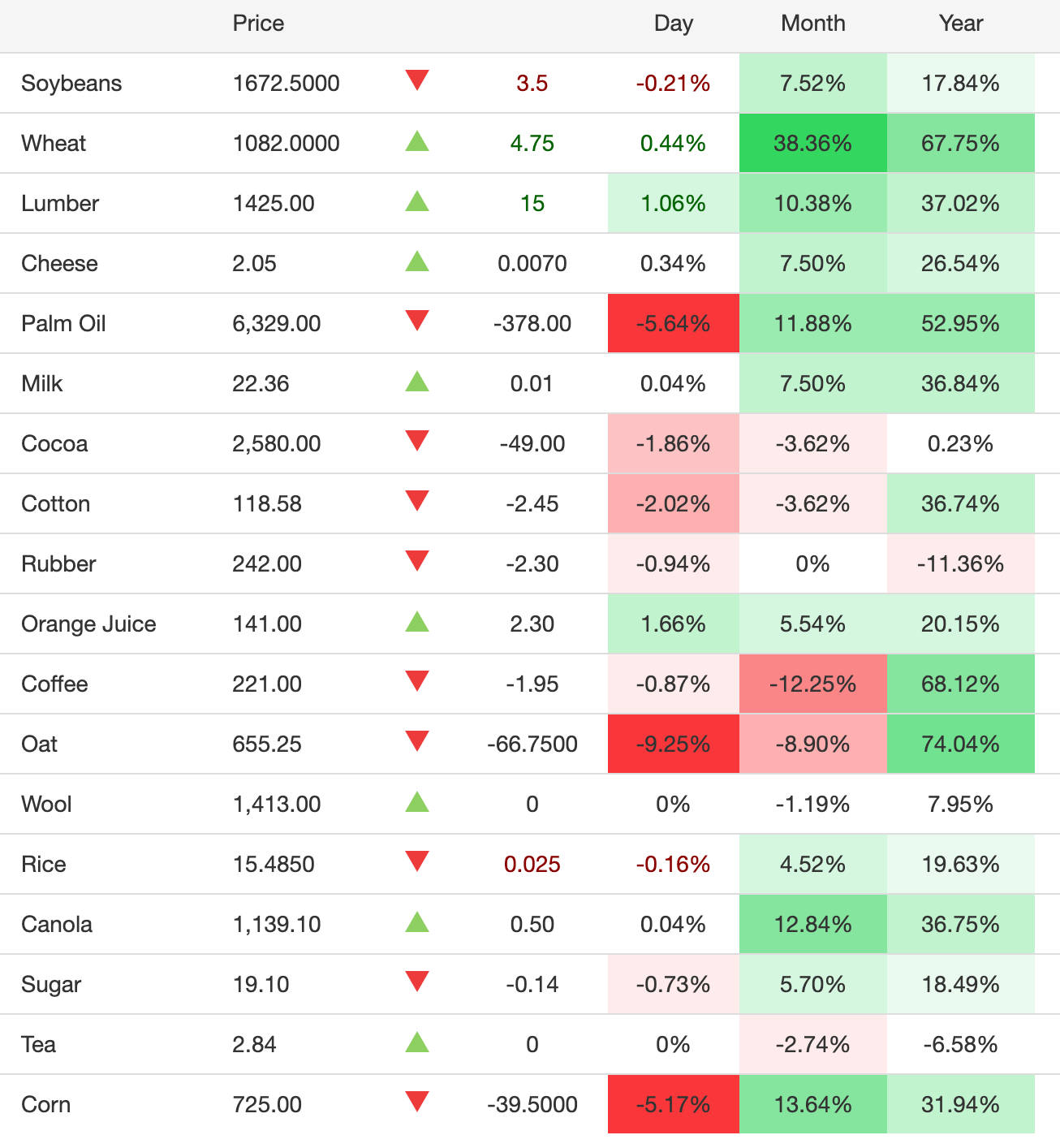

Wheat isn’t the only thing impacted. Here are a few more commodities. Source of data is here.

Monetary Policy Tightening

The Fed is meeting this week to map out next steps for quantitative tightening (QT) and increasing rates. Two weeks ago, Jerome Powell suggested a 0.25% increase in interest rates. This was before we saw the latest CPI data clocking in at 7.9%. We don’t know whether the rate hike will be 0.25% or 0.50%. What we do know is that we will get a rate hike. And we’ll likely get 5-7 of them in 2022.

This will have an impact on consumer demand.

Combining QT with rate hikes and price shocks in commodities alongside a yield curve inversion; this will put real pressure on the Fed triggering a recession.

The Fed has a near impossible job right now. Don’t increase rates? Inflation runs wild. Increase rates and do QT? Weaken consumer demand and cause a recession.

Time will tell how things turn out. As an enduring investor, it’s best to remain calm and collected in times like this. If you’re actively investing in individual equities, then it’s wise to underwrite businesses that have low debt, high operating margin and healthy cash flows. Don’t be a stock picker; buy good businesses. Otherwise, just invest in low-cost ETFs for the long-haul.

Any business that has very high P/E or no profitability will feel a real impact when market turns the corner and heads into a recession.

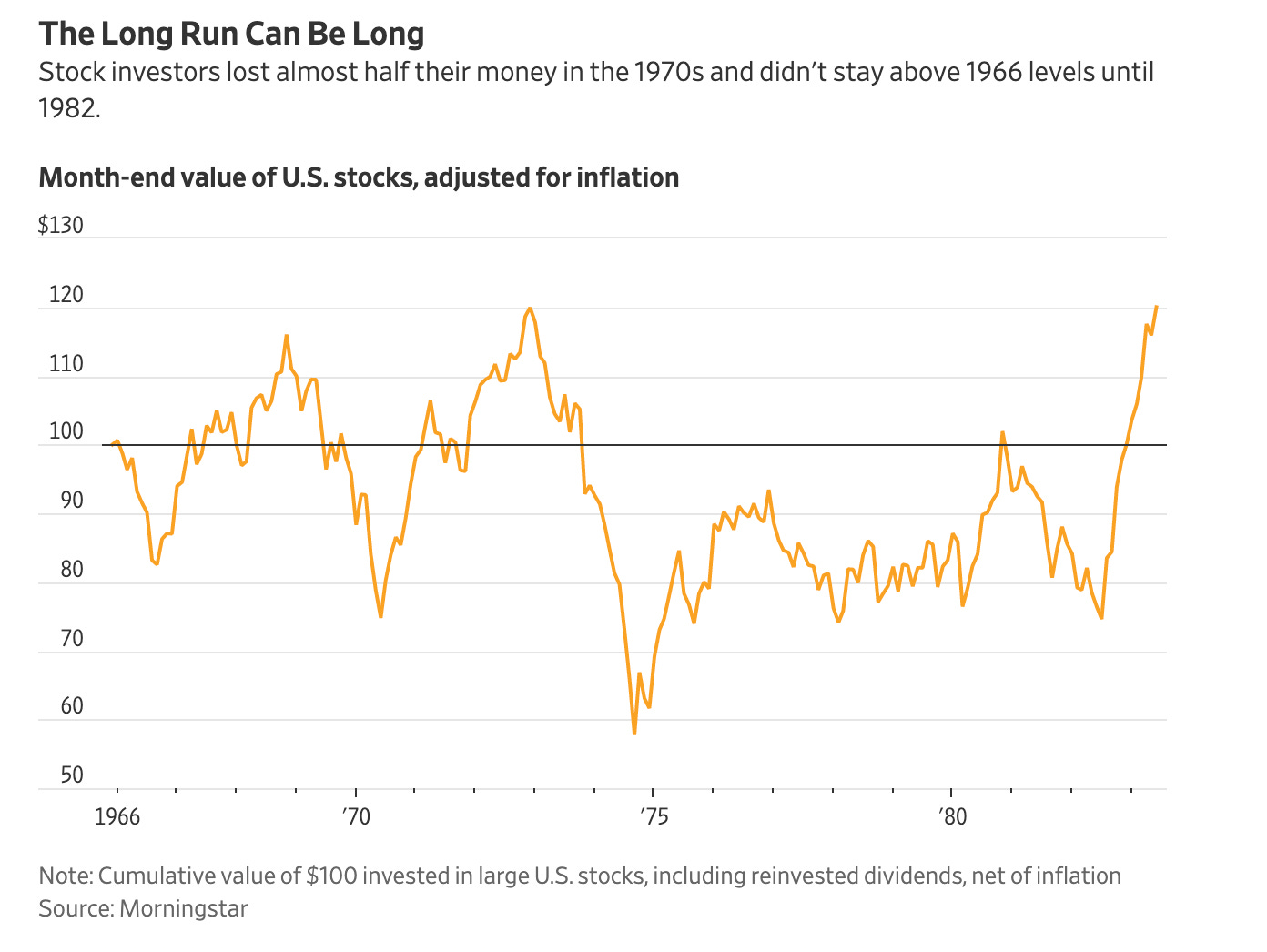

Patient investing is key to success in a volatile market environment. Because Long-term can actually feel very long.