It’s no surprise that GDP was compressed -32.9% in Q2 (link). A few weeks ago, I shared some thoughts on making sense of capital markets amidst COVID, where I discussed the original expectation of GDP compression being -42%.

Here’s what we can expect from Congress and The Fed in the near future.

Congress will continue to push for stimulus programs. With unemployment at record highs and individual consumption down meaningfully, this is a lever Congress can pull. This is a bipatisan issue that should be resolved asap.

The Fed effectively has two main tools in their toolbox. Controlling the money supply and affecting interest rates. With short term interest rates expected to be near 0 until 2021, we direct our energy to money supply. Today, The Fed is actively practicing quantitative easing (QE). If you’re unfamiliar with QE, here’s a snippet: The Fed can buy financial assets (often government bonds) to inject liquidity in the economy. It’s not always intuitive, but there are a few reasons why The Fed implements QE. Those reasons range from encouraging lending and borrowing, accompanying low interest rates; ultimately, aiming to stimulate the economy when there are fears of a deeper recession.

So, why is this important? Beyond the obvious, we need to keep an eye on consumption behaviors. People reading this are operators, business owners, executives, freelancers and analysts. GDP compression impacts all of us.

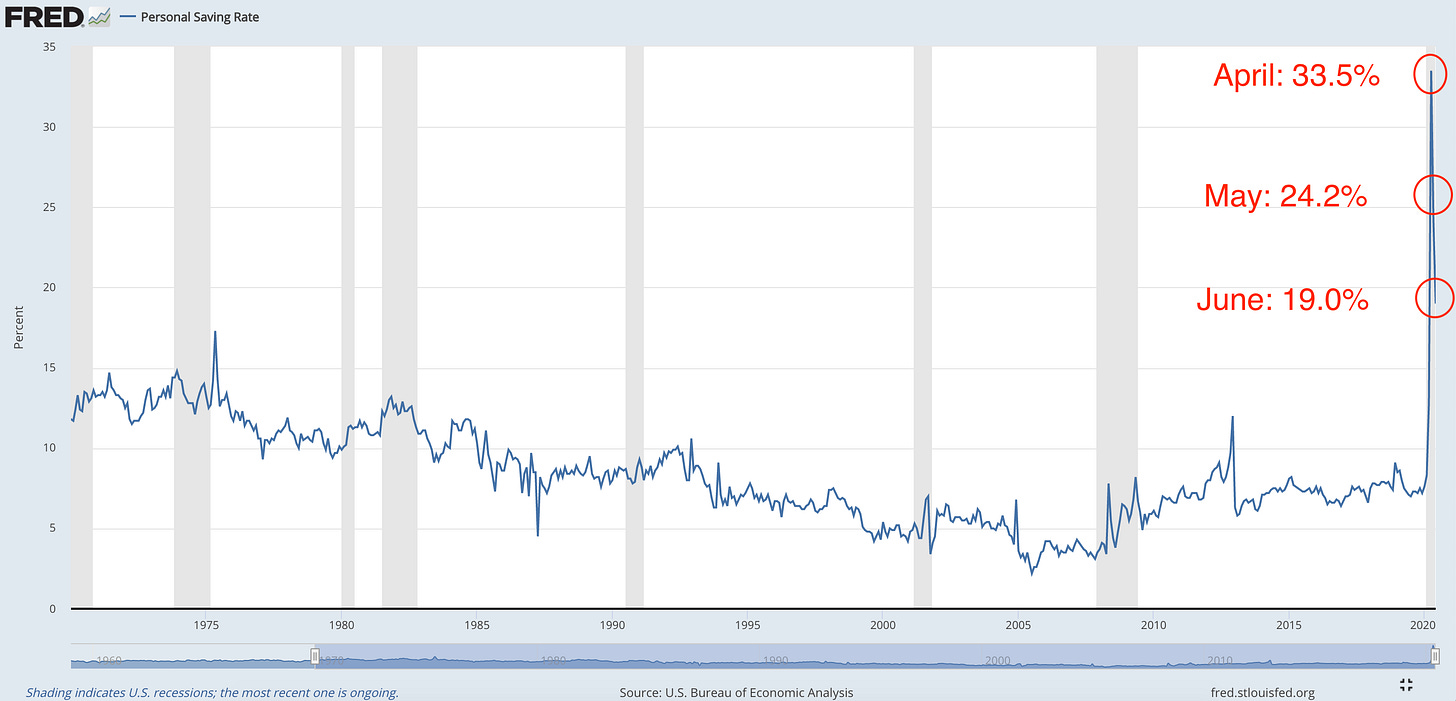

I’m keeping a close eye on personal savings rate. In April, the personal savings rate was the highest the United States has ever seen at 33.5%. In May, it dropped to 24.2% and in June 2020, it was 19.0%. The higher the personal savings rate, the more fear there is in the market and the less consumption. Because 70% of US GDP has historically relied on consumption, this is an overall positive trend from the worse of April 2020. If you want to know why higher personal savings rate is perceived as net-negative by economists, here’s a short essay on paradox of savings.