Everyone is seeking alpha. Daily. Every hour. Even on weekends.

For those unfamiliar, “alpha” is a term in finance that is designed to track additional returns on top of whatever benchmark was established for your portfolio. We all seek alpha in different areas of life. You paid $10 for a movie ticket and expected a certain utility from that experience. The movie ends up being phenomenal, the people you went with were close friends; the overall experience was above and beyond what you expected. You generated an alpha on your experience; you paid for a $10 experience and got the utility of a $100 experience.

As a marketer, you set your benchmark for a 3.0X return on ad spend (ROAS) and ended last month with a 5.0X; excess ROAS is your alpha.

List goes on.

When it comes to portfolio management, you’re seeking alpha all the time as well. Difference is that the alpha should be the excess return on top of a diversified portfolio strategy that should minimize unsystematic risk. Over the last week, Bitcoin had yet another rally. It’s up ~17% over the last 7 days and ~478% over the last year with most of the gains coming in the last 6 months. Human beings are not non-linear thinkers, so this type of asset appreciation is unparalleled. Bitcoin isn’t the only security that’s achieving non-linear growth; Ethereum, Tesla and many others are doing the same.

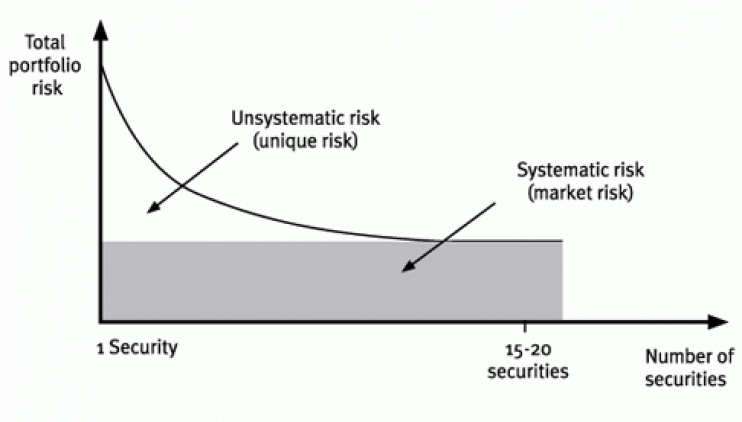

I’ve been writing about opportunities in these asset classes for a few months now, but we’ve hardly discussed the concept of unsystematic risk. This type of risk is very specific. Unlike systematic risk, which is more broad.

As a retailer investor, we should carefully manage unsystematic risk. You don’t have to avoid it. After all, if you’re seeking alpha, you need some unsystematic risk in your portfolio. But the focus here should be to generate alpha in a diversified portfolio.

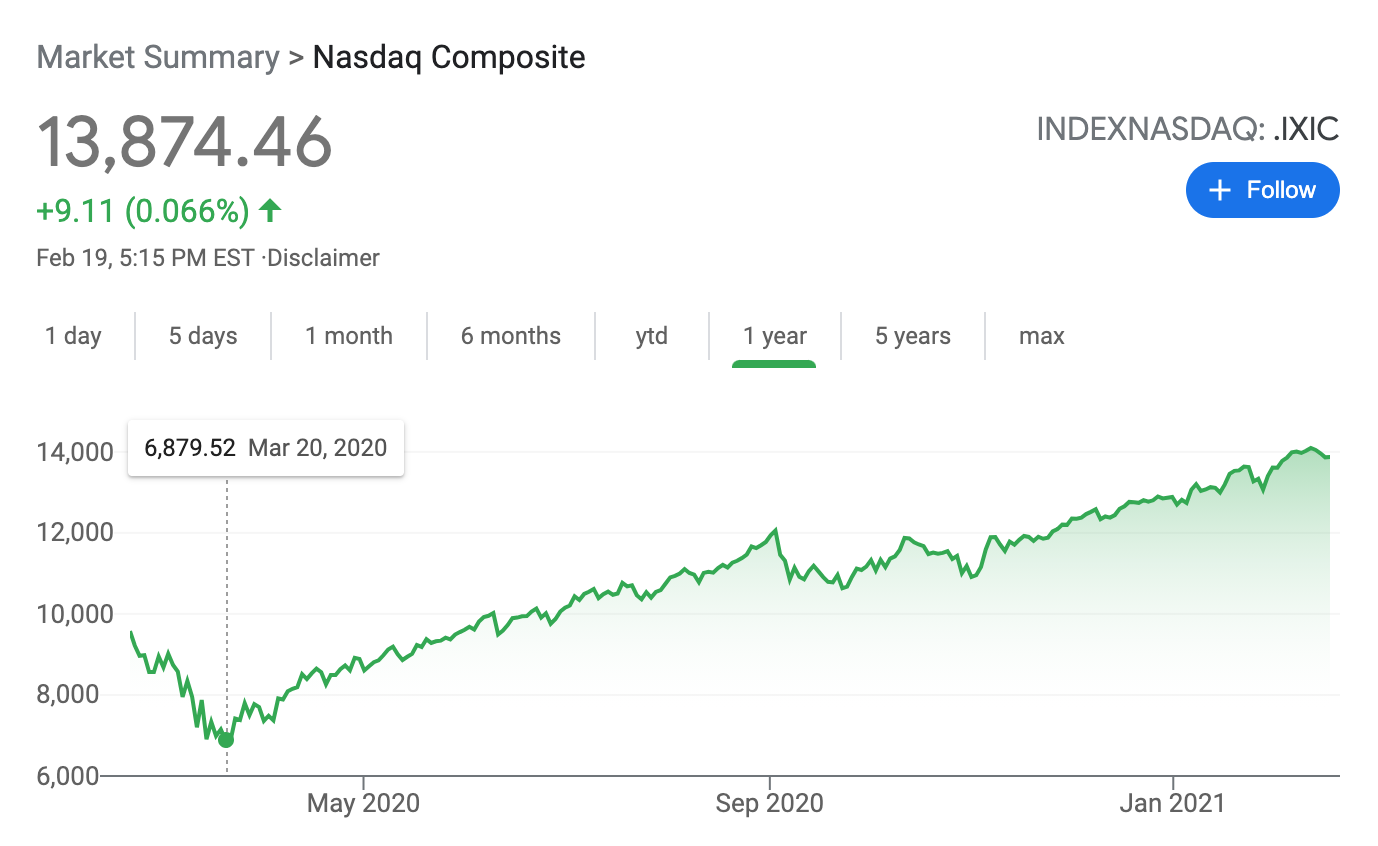

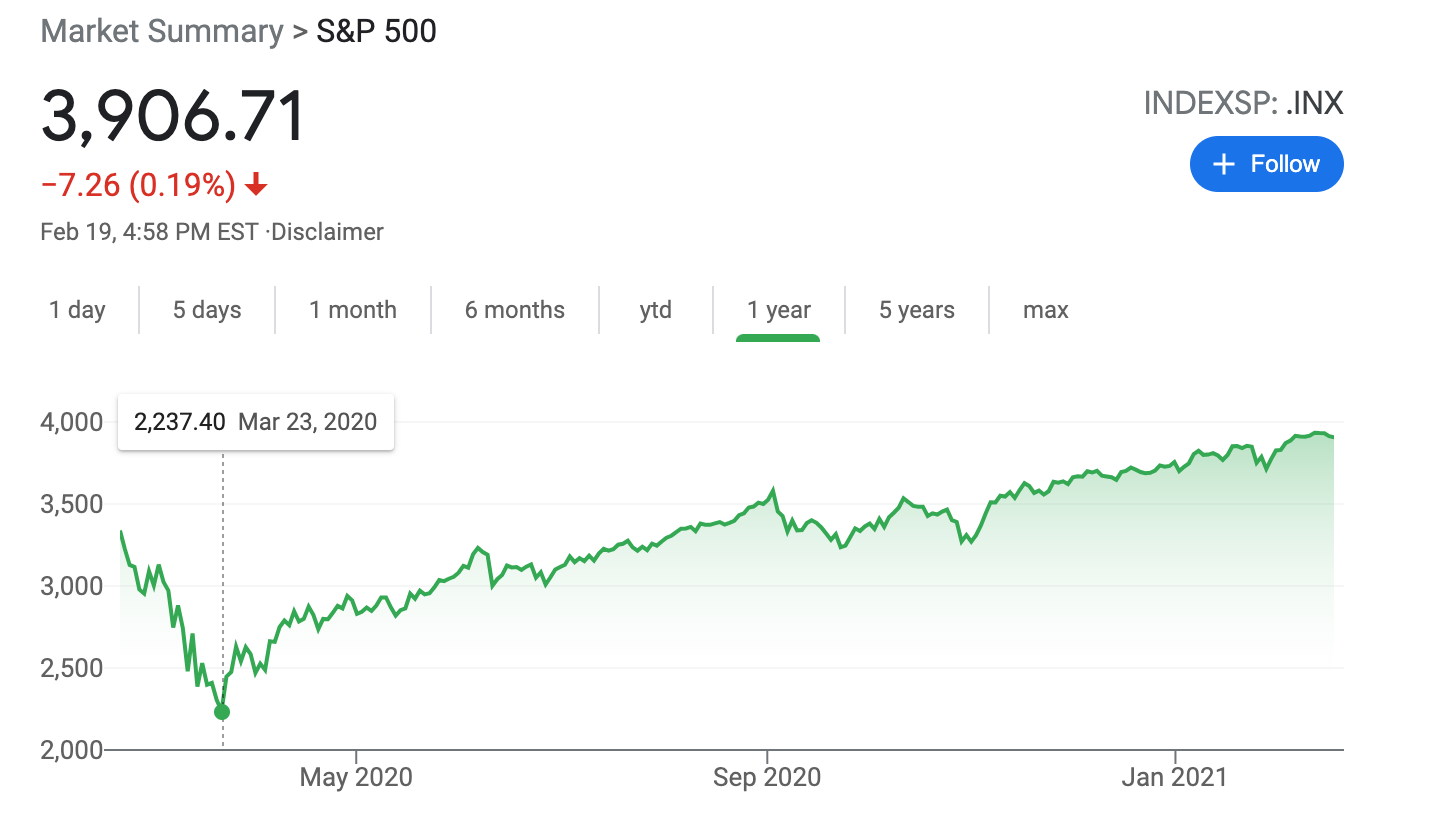

Over the last 12 months, the Fed has pushed for the most aggressive monetary policy measures which has driven liquidity through the roof… which has pushed capital markets to new ceilings. It feels like almost every asset class is winning except for USD. NASDAQ index is up ~100%+ from its bottom on March 23, 2020. S&P 500 index is up ~74% from its bottom on the same date.

I share this with you because investing in something like VOO (Vanguard’s low cost ETF that tracks S&P 500 index) has also yielded non-linear returns relative to other asset classes and historic performance. VOO is an example of an ETF that helps you diversify without pressures and stresses of unsystematic risk. This isn’t a pitch for VOO; I don’t care for any particular ETF or mutual fund. What I do recommend is ensuring that you’re nicely diversified across different asset classes. I encourage everyone to look for low cost index funds to help manage diversification in capital markets.

We’re living in the bubble of bubbles. One tweet from Elon Musk or Chamath can drive up the price of an asset. That’s speculative investing; that’s not how investing works. With inflation on the horizon, it’s critical for everyone to be a market participant. And as you’re becoming an active market participant, reflect on unsystematic risk. Don’t avoid it. Just learn to manage it.

Main image credit to bbalectures.com.